Alternative Lending

The Ultimate Guide for Loan Servicing Software

Table of Contents:

1. What is a loan management software?

2. How to Select the Best Loan Management Software?

3. Implementing Your Chosen Software

4. Security & Compliance

5. What are the typical loan management automations?

6. Keys to Successful Implementation of Chosen Loan Management Software

7.How long will it take to see ROI?

8. How Long Is The Implementation Process?

What is a loan management software?

A loan management software automates the workflow of a lending process. It can manage the entire lifecycle of a loan from origination, disbursement, closing, and everything in between.

Every company comes with its own set of unique requirements and demands, thus loan managements are often highly customizable and adaptable! Our loan management software, built on the Salesforce platform, allows alternative lending companies to streamline the entire process. FUNDINGO Loan Management Software comes with powerful built-in reports, dashboards, and alerts, providing complete visibility in every step.

The result? Greater efficiency, more revenue and profitability, with lower risk.

How to Select the Best Loan Management Software?

Choosing the right software for corporate support can be an overwhelming task, particularly when it relates to your core service. It is essential to understand the requirements of your business and only then proceed in a programmed manner to make the right choice. While it wouldn’t be far-fetched to call this a make-or-break decision for your business, we have made it easier for you by providing a framework for the right protocol.

From years of first-hand experience, we have summarized the essential practices required for choosing the right loan servicing and/or cloud lending software into 4 essential steps. With these 4 essential steps, you will be able to choose software with long-lasting benefits for your business.

- Assessing Your Needs

- Exploring Your Options

- Evaluating the Shortlisted Options

- Implementing Your Final Choice

Assessing Your Needs

Before you start exploring options for lending software, it’s best to consider some crucial internal factors of your business. These may include short-term and long-term requirements, goals of your business, the needs of your customers, the method of delivery for your software, etc.

Business Needs

Start the process of choosing the right cloud lending software by analyzing your business goals, requirements, and strategy. The lending software is meant to aid your business strategy so it should be aligned with your business goals. For this, you’ll need to sit down with your team and create a needs-gap analysis by going through some key questions, such as:

Where is your business standing today and where do you see it in the long term?

Is your current software system up to par? If not, then where is it lacking?

What additional functionalities could improve your current cloud lending software?

Could another cloud lending software provide improved credit scoring and enhanced automation?

Who would be using this software?

Would you opt for in-house lending software or off-site cloud lending software? Also, would you have a dedicated IT team for managing the in-house software system?

User Needs

For any business to succeed, it’s essential to know its users and their needs, so whatever you do, keep your users the center of your focus. Sit down with your entire team, from the top management to the loan lending officers who will be dealing with the customers first-hand. Conduct surveys among your users to find out how successful your potential software system will be practical.

Software Hosting Method

Another key factor that will impact your business is choosing the method of delivery for your loan lending software. There are two main methods to choose from:

- The first is the conventional method of purchasing a software license for an in-house software program. The license covers all the IT support staff that will be managing it. This in-house software and its database are physically loaded onto servers and your corporate computer systems, thereby allowing a user to use the system.

- The second method is called Software as a Service (SaaS), and it refers to an off-site, secure cloud lending software operated through a third-party organization. This option suits small to medium businesses, as you don’t have to arrange a dedicated IT team for it. The software is managed by the cloud lending software organization for a monthly fee.

Exploring Your Options

Once you’ve determined the internal requirements of your business, it’s best to explore what software options are available. Focus on key areas such as service functionality, flexible management, smart automation, and credit scoring. Once done, shortlist options that are excelling in these areas.

Software Functionality

An ideal cloud lending software partner has a flexible integrated origination and servicing platform. It offers individual modules, letting you choose what you need currently while always having the option to access more features if and when needed in the future. The loan origination features should include:

- Automated calculation of loan amount, term period of the loan, and the interest rate, etc.

- Automated decision-making

- Flexible management of the lender’s credit policies

- Remote access for different sales points

- Separate evaluation processes for different business products and business production lines

- Swift adjustment to new lending rules and policies

- Customized tracking

Smart Automation

As a business person, your goal is to opt for a software system that streamlines your process and allows you to increase revenues. Therefore, you should look for software that will automate several tedious tasks allowing your team to focus their energy on important decisions and tasks. The software must be flexible for managers to use according to their style, and it should be easy to integrate with multiple vendors.

Optimal Credit Scoring

Only a lending software that aids in risk management for both new and current accounts alike, will get you optimal credit scoring. The best program choices offer integration with all the credit reporting agencies. The best programs also make use of machine learning and data analysis. By incorporating artificial intelligence, these programs continuously update and improve their credit scoring capabilities, so it’s best to look for software choices that check the boxes for these traits.

Evaluating the Shortlisted Options

Once you’ve successfully found some great options on your hunt for the right cloud lending software, you may evaluate them further to get your business the right and worthy solution. You can start the evaluation process by getting to know your shortlisted finalists a bit better.

Create a carefully thought-out spreadsheet of important questions regarding their modules, customization scope, pricing, security, etc. Meet with their sales reps and ask them these questions. You may even request an online demonstration of their software. Note down any further questions that may arise during these demos and make sure to get your answers before making your final decision. You can even conduct surveys with their current clients to get a better picture. It’s better to be sure of what you’re signing up for, than suffering from business loss down the lane due to a hasty choice.

Affordability

Price is an important factor while choosing the right loan servicing software for your business, as you wouldn’t want to upset your resource allocation plans. Therefore, it’s best to opt for a provider offering only those functionalities that you require instead of paying for features you wouldn’t be utilizing. We would recommend choosing a software partner that allows you to access the functionalities you need and upgrade as your needs evolve. Keep all necessary, potential costs in check before making a decision. These costs include software and hardware costs, implementation costs, training costs, data conversion costs, etc.

Previous Performance History

Do not merely rely on the advertised credentials of a service provider, instead ask for demos and conduct surveys. Ensure that your potential servicing software provider has a proven performance history. You must ensure that lending is their core function, and not just a side hustle. Check for press publications regarding their performance. Also, see how long they have been in business. You can also check online for reviews of actual users and see if the provider has expanded over time and/or bagged any awards for their previous performance.

User-Friendly Installation and Operations

The right software is also easy to understand and implement. There is no benefit in saving on resources by opting for a cheaper option that isn’t easy to use, as all the ‘saved’ resources will have to be redirected on training your staff to understand it, and there still might be lots of errors and time and opportunities will be lost.

Therefore, choose software that can be readily and easily installed. This is another reason why we are slightly partial to cloud lending software. Secondly, your employees should be able to easily use it. It shouldn’t have manuals and instructions filled with lots of technical jargon.

24/7 Customer Service

When you’re an entrepreneur, you do not want to risk missing out on any opportunities due to technical failures or any reason whatsoever. That is why you must opt for lending software that offers 24/7 customer support to your employees. Also, the customer support staff must be experts in providing solutions to resolve issues in the first contact.

Implementing Your Final Choice

As lending businesses grow and expand, their offerings for loan products increase naturally followed by much-needed evolution in their regulations and policies. These changes often lead to an unavoidable need to root out their existing, straggling system and replace it with agile software.

That said, however necessary that replacement may be, it is never an easy decision to make and accept (at least initially). However, it is essential to not let fears get in the way of moving on to better things for enabling your business to climb the ladder of success. When you’re in the lending business you are well aware of the core importance of a loan servicing software.

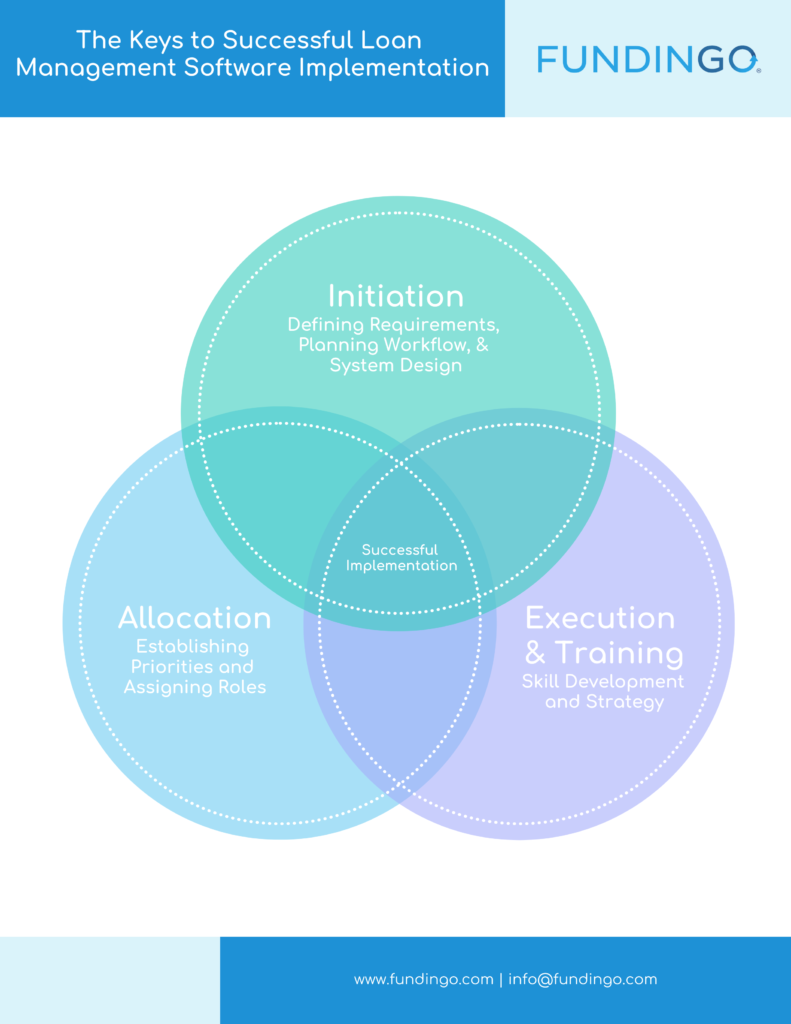

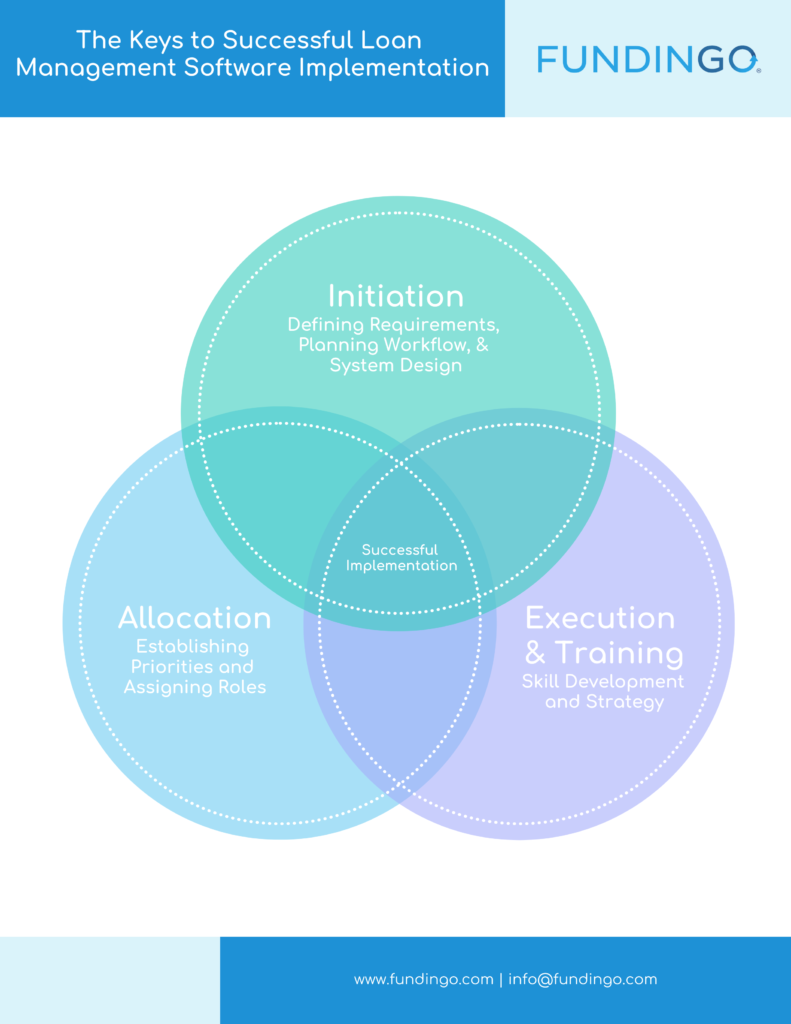

Loan servicing software is what keeps tabs on all your details such as your policies, loan terms, interest rates, loan payments, and collections. This makes it all the tougher to choose the best loan management system, and once you’ve made your decision, it’s important to be aware of the key factors that enable smooth and successful implementation. These are the top three factors that our team has determined from its extensive experience:

- Initiation – Defining Requirements, Planning Workflow, & System Design

- Allocation – Establishing Priorities and Assigning Roles

- Execution and Training

Initiation – Defining Requirements, Planning Workflow, & System Design

As mentioned above, you cannot stress enough the importance of the right loan servicing software when you are in the lending business- therefore you must carefully determine the right software for your organization. Being clear in your requirements is the first and most important step in flawless implementation. For this, all team members must share their input which must be valued and carefully studied. This includes the departments of collections and customer service as well.

Ensure the use of the same terminology regarding the new software among the entire workforce i.e., your in-house team as well as your loan servicing software provider. This will ease communication and understanding. That said, the software implementation manager must draw a detailed outline regarding the project plan and conduct a launching meeting to explain new workflows, project requirements, establish milestones, and set expectations regarding the completion of implementation.

Allocation – Establishing Priorities and Assigning Roles

Once the implementation process has been initiated and the workflow with the new loan servicing software has been designed, you will need to finalize the scope of the implementation. You must establish priorities keeping any prerequisites into account, divide the implementation process into smaller phases, meet deadlines, and ensure that the most important tasks are catered to before the others.

In the whole stage of allocation, the lender must take and exhibit proper sole project ownership. Consultants, vendors, and even your employees are there to serve their essential individual roles in the process. As a lender, however, you know your business the best and you alone truly know the details and importance of your business goals. Use that ambition and knowledge to ensure the completion of the implementation process. If a lender doesn’t take project ownership, that ship is bound to hit rock bottom.

The lender must put together a committee of executives who take ownership of the project, ease decision making, cater to the need for resources, and encourage accountability. There must also be a dedicated project manager who solely focuses his energy, efforts, and skills on keeping the implementation process steady and the team organized. Moreover, the project team member must be empowered to make decisions to support the strategies that are a part of your business case. Otherwise, they will have to seek approval from multiple layers of senior management even for small business decisions. Therefore, to avoid delay in the implementation process, you must ensure that your team is sufficiently empowered.

Moreover, when it comes to key areas of your lending business such as accounts, collections, IT, and customer service, you must identify the experts. The experts will be able to promptly deal with any issues in their domains and will save you precious time, thereby facilitating the implementation process. With that done, you must conduct regular staff meetings to keep tabs on the software implementation status and to ensure transparency, visibility, and good pace. We at Fundingo, hope that you will benefit from the insights gained from our experience of facilitating clients with our software implementation for years.

Execution and Training

If your team isn’t trained to use and manage the new loan servicing software, by the time it goes live, it will create a lot of lag and chaos. Therefore, you must develop a training schedule in a timely manner and begin it as soon as possible. The training sessions can be conducted on-site, online, or be pre-recorded. Use workflows from the initiation phase of software implementation for the user training content. The need to prepare your business organization workforce and your user communities to use the new software is crucial. You will need to prepare an effective communication strategy that clears any ambiguities the users may have. You must set the tone right from the very start and make sure to answer the key questions that people may have in their minds such as:

Why are you opting for new software?

Which issues will the new software resolve? (in case your firm is not a new venture)

How will it benefit the end-user?

When will the changes occur?

How will those changes be implemented?

Communicate the answers to these questions through frequent communication, short and precise demos, and newsletters. Once you have sufficiently trained your personnel and everybody knows their duties, has a thorough understanding of the new software both in terms of usage and expectations, and set up a date for going live with your new software, make sure to assign minimal work for that date. On a side note, it’s always a good idea to choose a weekend for going live.

Even after your new loan servicing software has been successfully implemented, it’s best to maintain ongoing support for all those dealing with it firsthand. Arrange additional training sessions, provide tech support, and always be ready to facilitate your entire team as implementation is only the beginning of your fresh start.

Requirements for software security and compliance

In the current digital age, security and compliance are more important than ever. Lenders are often bombarded with threats making qualification and certainty of the utmost importance. LexisNexis provides risk investigations and due diligence to Fundingo through their integration on the Salesforce AppExchange. It quickly evaluates your customers, businesses, and third-party vendors to verify their identities, investigate using proven solutions and discover any critical connections that may signal risk. With automated screening, ensuring security, compliance, and mitigating risk and liability are easier than ever.

Through Watchlist Screening, you can simplify your compliance workflows through LexisNexis’ streamlined screening processes and robust databases. With coverage of over 1,500 watchlists and advanced screening technology, you can

- Automate watchlist screening

- Minimize false positives and alerts

- Integrate watchlist intelligence directly into your CRM

- Ensure hiring compliance when hiring and acquiring clients

- Establish compliance with regulations such as

- USA PATRIOT Act • Bank Secrecy Act (BSA) • Anti-Money Laundering regulations • OFAC Sanctions • Fifth EU Anti-Money Laundering Directive • SWIFT, ACH and Fedwire protocols

What are the typical loan management automations?

Loan management software streamline every workflow from origination to closing through automation.

Fundingo’s Loan Origination Software

- Collects applicant information

- Manages accounts

- Identifies the best funding sources

- Handles offers and contracts electronically

- Allows users to submit a deal with attachments to multiple lenders at once via The Submission Wizard

Fundingo’s Loan Underwriting Software

- Organizes all your information in one place

- Generates pricing options

- Pulls credit information, bank statements, and other types of data and reports

Fundingo’s Loan Servicing Software

- Transfers all relevant information for loan servicing directly from underwriting

- Track renewals

- Manage disbursements

- Automate fees

Keys to Successful Implementation of Chosen Loan Management Software

- Defining requirements.

- Plan the workflow.

- System design.

- Delegation – establishing priorities and assigning roles within the process.

- The execution and training process.

How Long Will It Take to See Return On Investment?

Seeing a return on investment will often depend on a number of factors such as cumulative cost, maintenance costs, and market power. These rates vary depending on each business!

How Long Is The Implementation Process?

Implementation consists of the following steps:

- Kick off meeting

- Business process review

- Requirement analysis design

- Training

- Data migration

- Deployment

Every business will come with its own set of requirements, often demanding customizations and adjustments. This will vary the timing of each step in order to fully cater to each unique need.

Having a streamlined, effective loan servicing software can be the answer to running an successful business. By automating core functions and removing manual processes, lending companies position themselves to expand profits and increase scalability. Solutions can include integrations for security, qualification, credit reporting, and more. With the ability to automate, integrate, and customize, loan servicing software is an essential tool to lending companies.

Alternative Lending

Keys to Successful Implementation of Your Loan Servicing Software

As lending businesses grow and expand, their offerings for loan products increase naturally followed by much-needed evolution in their regulations and policies. These changes often lead to an unavoidable need to root out their existing, straggling system and replace it with agile software.

That said, however necessary that replacement may be, it is never an easy decision to make and accept (at least initially). However, it is essential to not let fears get in the way of moving on to better things for enabling your business to climb the ladder of success, and when you’re in the lending business you are well aware of the core importance of a loan servicing software.

Loan servicing software is what keeps tabs on all your details such as your policies, loan terms, interest rates, loan payments, and collections. This makes it all the tougher to choose the best loan management system, and once you’ve made your decision, it’s important to be aware of the key factors that enable smooth and successful implementation. These are the top three factors that our team has determined from its extensive experience:

- Initiation – Defining Requirements, Planning Workflow, & System Design

- Allocation – Establishing Priorities and Assigning Roles

- Execution and Training

Initiation – Defining Requirements, Planning Workflow, & System Design

As mentioned above, you cannot stress enough the importance of the right loan servicing software when you are in the lending business- therefore you must carefully determine the right software for your organization. Being clear in your requirements is the first and most important step in flawless implementation. For this, all team members must share their input which must be valued and carefully studied. This includes the departments of collections and customer service as well.

Ensure the use of the same terminology regarding the new software among the entire workforce i.e., your in-house team as well as your loan servicing software provider. This will ease communication and understanding. That said, the software implementation manager must draw a detailed outline regarding the project plan and conduct a launching meeting to explain new workflows, project requirements, establish milestones, and set expectations regarding the completion of implementation.

Allocation – Establishing Priorities and Assigning Roles

Once the implementation process has been initiated and the workflow with the new loan servicing software has been designed, you will need to finalize the scope of the implementation. You must establish priorities keeping any prerequisites into account, divide the implementation process into smaller phases, meet deadlines, and ensure that the most important tasks are catered to before the others.

In the whole stage of allocation, the lender must take and exhibit proper sole project ownership. Consultants, vendors, and even your employees are there to just serve their essential individual roles in the process. As a lender, however, you know your business the best and you alone truly know the details and importance of your business goals. Use that ambition and knowledge to ensure the completion of the implementation process. If a lender doesn’t take project ownership, that ship is bound to hit rock bottom.

The lender must put together a committee of executives who take ownership of the project, ease decision making, cater to the need for resources, and encourage accountability. There must also be a dedicated project manager who solely focuses his energy, efforts, and skills on keeping the implementation process steady and the team organized. Moreover, the project team member must be empowered to make decisions to support the strategies that are a part of your business case. Otherwise, they will have to seek approval from multiple layers of senior management even for small business decisions. Therefore, to avoid delay in the implementation process, you must ensure that your team is sufficiently empowered.

Moreover, when it comes to key areas of your lending business such as accounts, collections, IT, and customer service, you must identify the experts. The experts will be able to promptly deal with any issues in their domains and will save you precious time, thereby facilitating the implementation process. With that done, you must conduct regular staff meetings to keep tabs on the software implementation status and to ensure transparency, visibility, and good pace. We at Fundingo, hope that you will benefit from the insights gained from our experience of facilitating clients with our software implementation for years.

Execution and Training

If your team isn’t trained to use and manage the new loan servicing software, by the time it goes live, it will create a lot of lag and chaos. Therefore, you must develop a training schedule in a timely manner and begin it as soon as possible. The training sessions can be conducted on-site, online, or be pre-recorded. Use workflows from the initiation phase of software implementation for the user training content. The need to prepare your business organization workforce and your user communities to use the new software is crucial. You will need to prepare an effective communication strategy that clears any ambiguities the users may have. You must set the tone right from the very start and make sure to answer the key questions that people may have in their minds such as:

- Why are you opting for new software?

- Which issues will the new software resolve? (in case your firm is not a new venture)

- How will it benefit the end-user?

- When will the changes occur?

- How will those changes be implemented?

Communicate the answers to these questions through frequent communication, short and precise demos, and newsletters. Once you have sufficiently trained your personnel and everybody knows their duties, has a thorough understanding of the new software both in terms of usage and expectations, and set up a date for going live with your new software, make sure to assign minimal work for that date. On a side note, it’s always a good idea to choose a weekend for going live.

Even after your now loan servicing software has been successfully implemented, it’s best to maintain ongoing support for all those dealing with it firsthand. Arrange additional training sessions, provide tech support, and always be ready to facilitate your entire team as implementation is only the beginning of your fresh start.

Alternative Lending

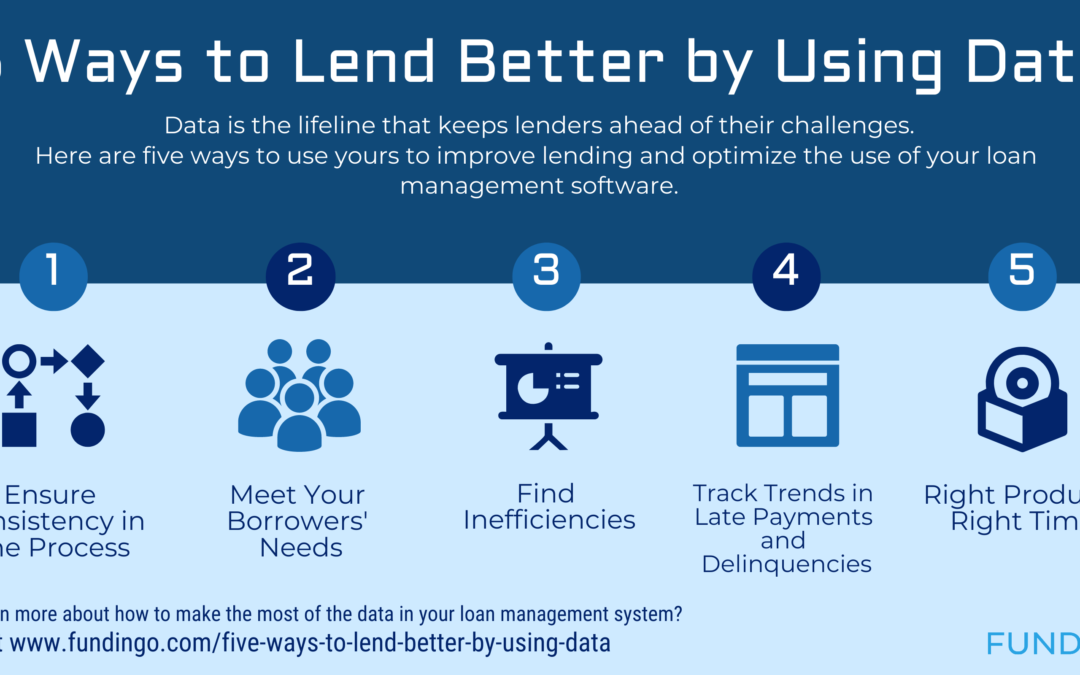

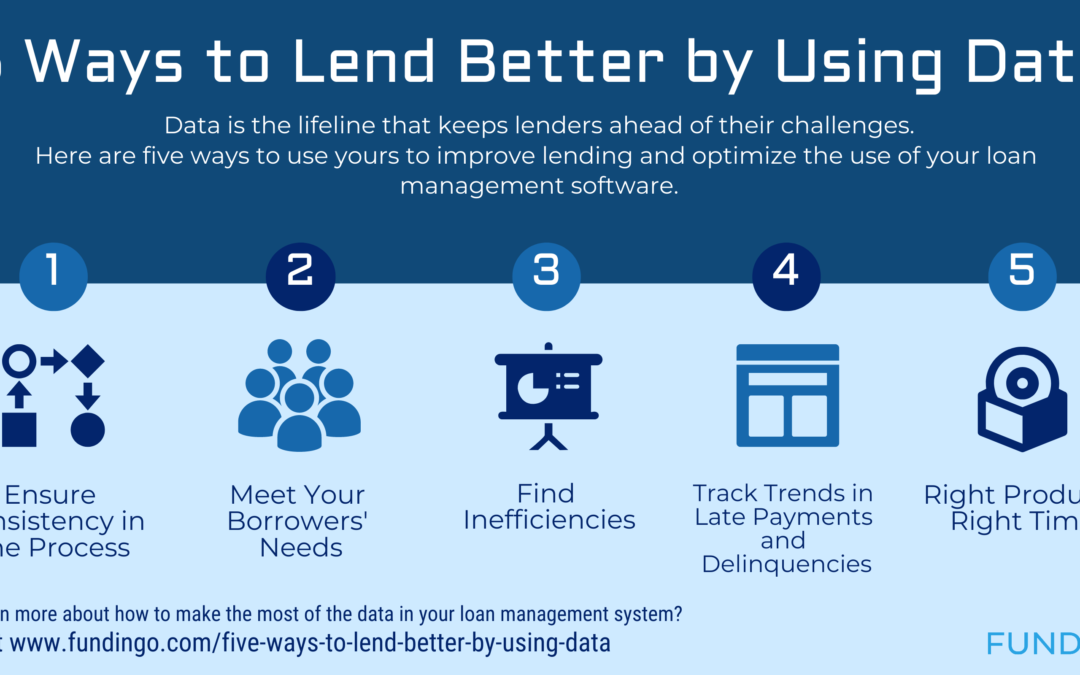

What are the two types of lenders who won’t last? Those who don’t use their data.

All jokes aside, data is the lifeline that keeps lenders ahead of their challenges. There will never be a time with no struggles to overcome. The way that every financial institution has endured is by planning with data.

Who are lending metrics really for?

Smaller lenders may think they’re exempt from the rule that businesses need data. That couldn’t be farther from the truth. Small lenders significantly benefit from collecting and analyzing their lending metrics. While larger firms can weather a little more damage, others need to carefully plan each step for their success.

Some of the most valuable information likely won’t come from any one lender. Instead, compiled industry data should guide your next steps. For example, mortgage lenders should stay on top of property records and the movement of assets to make educated decisions. It can also help you steer clear of trouble. Market watching, especially during a recession, can prepare lenders for what’s to come.

The new-tech jitters?

It’s not uncommon for fear of technology to hold lenders back from capturing and utilizing their data. And reasonably so. For someone whose business is money, the idea of losing both time and money by adding tech is an absolute no. If your staff is not tech-savvy, the apprehensions grow.

That said, the tech that lenders use knows about these apprehensions. Many have full teams to handle implementing the tech and training your staff. In any case, it’s good practice to outline your concerns with your team before interviewing tech providers.

So, what are the five ways data can improve your lending

1. Ensure consistency in processes

How can you be sure you’re following the right protocol if you have nothing to check? Missing information, disorganized flows, and fragmented processes cost time and resources. However, just a little time spent organizing your process results in mountains of useful information.

First, make sure you know what you want from your data. What processes are you trying to improve? Are you already experiencing a problem or looking to enhance your existing flows? Once you have what you want, see what your current data has and lacks. To get the best insights, you’ll need high-quality data.

Some loan management software will go as far as to alert you to inconsistencies. Of course, with unified data, you can then compare deals and pull more significant insights. Every insight you get depends on the quality of your data. Make sure that it’s complete.

2. Meet your borrowers’ needs

How can you tell that you’re taking action on your deals on time? Do you have a log of communications with your customers? If you don’t, you may be missing significant opportunities to cultivate repeat deals.

Studies show that your customer experience is the number one factor clients consider when selecting software. These experiences don’t just include how they interact with your technology, but also your customer service and overall speed.

When you begin, start with a baseline assessment of your customers’ experience. For example, what are your current metrics for customer care? How are you collecting them? If you have trouble answering those questions, then think hard about the software you’re using.

Cloud lending software lets you see the detailed history of your communications with your borrowers. If one or more deals encounters an ongoing problem, you can see the email chain, messages, and actions taken to solve it. In a similar respect, this brings systemic issues to the surface, so you don’t have to spend as much time searching.

3. Find inefficiencies

Speaking of, do you know how long you spend finding those systemic issues? After ensuring your data is complete, you can then understand the amount of time spent on any given step. Digital lending apps eliminate most duplicate processes, but some may still slip past you. Take a close look and detailing your procedures using your data. Where do you see redundant, time-consuming, or unnecessary steps?

These analyses are necessary under normal circumstances but critical in financial downturns. Collecting essential data during prosperous times helps your business pull through its struggles. Knowing how to identify them early is one of the superpowers of data for lending.

And what about those wasteful processes? You can use them to identify opportunities to optimize pieces of your lending with AI or process integrations.

4. Track trends in late payments and delinquencies

Late payments happen. Delinquencies, too. But when is a one-time event really part of a bigger pattern?

Digital lending systems can highlight deals or borrowers with repeated missed payments and highlight risk factors before they go into default. Considering the challenges lenders face, looking at new risk indicators is the only way to stay afloat.

What is your company’s plan to ride out the next financial downturn? Of course, they will happen, but you must steer yourself to safety with data. By collecting data both in good times and bad, you learn where (and where not) to steer your operations.

5. Right product, right time

You may think you know your clients inside and out. How can you be sure without data? Smart, data-driven lending covers more than knowing how they work. It helps you offer them the right product at the right time for the right price.

Demographics data guides you to your customers. After all, the needs, preferences, and results that baby boomers value are undoubtedly different from younger generations. Your demographic guides you on how to structure and price your loans. Offering the right product to the right audience has the bonus of increasing originations and lowering delinquency rates.

Final thoughts

Lending without data is a lucky guess at best. Especially in uncertain times, your lending NEEDS data to survive. Keep in mind that your competitors may already be using this and more in their lending. While other factors, like your software and team, steer your company in the right direction, the only test to be sure lies within your data. Only then can you begin to prepare your lending for future trends.

Having apprehensions about technology is expected. Keep them in mind and discuss them when addressing your software and lending metrics. These apprehensions are not a barrier to your use of data but essential considerations that help you find the right fit. Remember, data is there to help you. It’s the map that leads you to your destination.

Alternative Lending

All across the country, office buildings lie empty. Hotels have closed, some unsure that they will reopen. New constructions have halted, and funding grows scarce. Is this the end of our old way of commercial real estate? Or is it the birth of something new?

The initial shock of the pandemic alarmed professionals across the construction loan industry. Complications resulting from COVID-related restrictions and the work from home shift halted office construction projects—lack of business and vacation travel affected hotels and spaces catering to corporate events. Even if a vaccine were released tomorrow, hesitation among banks and lenders would still fail to return new construction to its pre-pandemic life. So, where does that leave us now?

The Current State of Construction Lending

Currently, market forecasts predict a 10.5% decline annually in effective rents in the top 79 metro office markets. Compared to the decrease in 2009, which was 8.9%, the figure initially looks alarming. However, not all cities across the country will be affected equally.

For example, the areas predicted to perform worse are predominantly metro areas experiencing a high number of COVID-19 cases. Many are also affected by strict lockdown measures. Other cities with slower expected recoveries include those experiencing difficulty containing their outbreaks.

How the markets respond following the pandemic depends on how cities maintain their control over the virus. Lenders will undoubtedly resume activities sooner in areas with greater control over the outbreak first. Other contenders include those with reliable data on their recoveries and plans to manage the virus’s spread.

In the same respect, a lack of reliable reporting could hurt some areas’ chances of receiving funding. Traditional lenders are naturally cautious as they do not have the data they need to predict whether borrowers can repay. While alternative lenders offering construction loans may have more flexible criteria for borrowers, they too are moving forward with caution.

Who Else Is Affected By The New Construction Slump?

Much like office construction, COVID-19 sideswiped the tourism industry. While cities’ initial restrictions have lifted, many now reimposed rules or bans on travel to contain the virus’s spread. Personal travel is at a comparative standstill and business events have opted to go virtual. Now, even corporate events no longer guarantee hotel bookings.

The concern over having many people in closed space drives similar worries for multifamily housing. Shortages in labor and construction materials that affected the industry early on have lessened. Now, lenders’ concerns look to the long-term feasibility of traditional multifamily housing.

What Will The Future Look Like?

Does this mean that the new construction market will not recover? Not necessarily. The recovery will not result in the same kinds of projects seen before the outbreak but will offer new opportunities to lenders willing to take the risk.

For example, in the 1980s, the savings and loan crisis toppled the commercial real estate market. However, as a response, mortgage-backed securities were born. The dot com boom and its subsequent collapse impacted Silicon Valley’s commercial property value even harder than COVID. These events are nothing new to finance. However, reliable data is currently scarce; the lenders that lead the recovery will have to make the best of the information they have and think differently about who they fund.

As mentioned, previously safe construction investments such as multifamily housing have lost their appeal to lenders. Renters are struggling with their payments, and those who can buy are moving to less densely-populated areas.

Even those living in apartments will still need housing, and more people than ever can benefit from more affordable options. While this does not mean multifamily construction will continue as it was before the pandemic, it does mean that its next steps will follow a different path. Affordable multifamily housing must be a priority and must involve other options apart from traditional apartment buildings.

What Are Construction Lending’s Options?

One possible option is modular housing, which has a far lower overall cost and quicker construction time than standard apartment buildings. However, borrowers for modular multifamily units typically require more capital upfront. Their increased need rules out financing options with many traditional lenders.

Since most modular construction happens in the company’s warehouse, lenders cannot assess the projects as easily as they would with standard apartments. Many are concerned about their ability to ensure that builders are meeting their milestones in the planned timeline. Since modular multifamily housing is relatively new, assessing property value poses another challenge.

Similarly, eco-friendly construction projects present new risks and opportunities to lenders. Updated ventilation and climate control methods prevent future virus outbreaks and reduce the buildings’ overall carbon footprints. Additionally, lenders can bank on borrowers’ increased ability to repay due to decreased costs over time.

What Has to Change For Construction Lending’s Survival?

In order to construct buildings that will survive this pandemic and future unknowns, they must be built with personal and environmental safety in mind. This shift also means older buildings with closed spaces and poor ventilation will have to be retrofitted to stay in use. To make heating and cooling more efficient, current office buildings are tightly sealed to prevent air leakage. Now, buildings need to heat and cool efficiently while also permitting airflow.

Despite all the recent changes in construction, traditional lenders and banks still have to adhere to pre-COVID regulations. Though construction’s needs are changing, the rigidity of their system makes it hard to accommodate them. There is still not enough data on the kinds of projects that will lead the recovery for them to make it usable. Further bumps in the road may also. So, where does this leave us?

What Does This Mean for Alternative Lenders?

Alternative lenders face a tremendous opportunity. In areas where traditional lending falls short, they can afford more flexible terms and finance projects that will weather future challenges. This is not, however, to say that they should approach the situation without examining new risks. Lenders should pay close attention to the areas in which borrowers plan to build and how its reopening has progressed. Additionally, the number of businesses shifting to permanent distance work may affect even the most promising locations.

So, where does that leave the industry now? Ultimately, lenders will have to open themselves to new opportunities and risks, finding different ways to assess borrowers and evaluate risk. Much like the response to former crises, legislation may change to make it easier for lenders to finance future projects that aid in the recovery.

Closing Notes

When pressed by the need to finance new projects, governments, borrowers, and lenders will have to come together on a plan to address the change. While traditional loans may not be feasible, changes in the industry and new ideas from alternative lenders provide much-needed opportunities. Work, travel, and life at home may not be the same, but the most crucial place to look is the future. How can we embrace the change in a way that moves us forward? Alternative lenders will ultimately be those who decide.

Alternative Lending, Real Estate

Though finance is seeing its peak of online interactions, one sector still lags. Due to a complicated history of legislation, mortgage lending has taken place primarily in person since its beginning. Now, with online finance lagging in the pandemic recovery, how far does mortgage lending have to catch up?

Consider how far the process of buying a house has come in the last 20 years. Buyers can find homes as easily online as they once could with real estate agents (and at a significantly reduced cost). They can shop for a mortgage online and see their potential rates in different areas. Legal questions can be asked and answered online, saving them time and lawyer fees. So why do they still have to complete the process of mortgage borrowing mainly in person?

If you consider the history of mortgage lending and its first steps into the digital realm, the reasons become clear. Regardless of its roots, mortgage lending must catch up with its digital siblings to stay afloat. Otherwise, like many businesses affected by the pandemic and changing demographics, it will see itself replaced by other services as well.

The Origins of Online Lending

The roots of online mortgage lending go back to the late ’90s. Its first obstacle to overcome was the process of signing documents. Historically, document signing took place in person only with no legal alternatives. This method of signing was the only option until the advent of the e-signature. Its invention, however, did not see the most comfortable start. Concerns of fraud led to uncertainty among states, snowballing into confusing (and sometimes even contradictory) legislation on a state level.

The biggest challenge with this method was the e-signature’s validity across state lines. While some states legislation was compatible, others left both signers and lenders perplexed. For instance, what if signers lived in different states? Whose state rules took precedence over the interaction? And if brought to court, would it indeed be legal? Without proper guidance, signers were reluctant to make the shift to e-signatures on their documents. Their caution and lack of federal action held back the industry from its next step forward.

Later, e-signatures were legalized throughout the US one law, called the Uniform Electronic Transactions Act. This act eliminated conflicting regulations governing each state and made online signatures uniformly legal throughout the United States. The federal ruling overrode the conflicting individual legislations and confusing fraud protections that had scared many away from digitally signing.

Digital signatures have since allowed individuals and businesses to take advantage of the convenience of online operations. Signing contracts can take place in different parts of the country without the concern of their legality. However, the movement from a hybrid to a digital lending process is not yet complete. Now that signing could take place online, the next biggest hurdle is notarization.

Current-Day Struggles

While many parts of the lending process can take place online, notarization still takes place in person. Now, online loan applications are commonplace, with millennials seeking out online experiences versus in person for convenience and safety. This change means that lenders will have to move from paper operations to digital systems to keep up with the demand. If not, they risk being replaced by lenders that will.

A shifting demographic is not the only reason for lenders to push for online mortgages. Not only does it benefit their borrowers, but it reduces effort on the lenders’ side. A report from the New York Federal Reserve concluded that the processing time for online mortgages and refinancing is significantly less than in-person or hybrid transactions. It stated that processing took an average of 14 days fewer when refinancing with online lenders versus the alternatives, and processing for purchases took 90 shorter on average.

Though hesitation is common among lenders, increased demand for funding and pressure to operate digitally strain their current practices. That said, their skepticism is not unwarranted. Even the most willing still exist in a landscape where legislation has not kept up with their new needs.

Challenging Times

Naturally, many lenders are apprehensive when considering changing from their current methods. Legislation, rigid legacy software, and the perceived difficulty of change hold back businesses from keeping up with the present. However, the reduced labor and digitalized processes will no longer be optional, but critical to their businesses’ survival.

Given the pressing financial landscape, reduced processing time is a significant benefit. More individuals are applying for mortgages and refinancing because of pandemic stress. Families now have to share spaces for even more time, with children only beginning to return to school and many colleges refusing to open dorms.

What Does the Future Hold?

Now, lending is bowing from the pressure to adapt to a new demographic and the pandemic’s urgency. The next obstacle to overcome is the struggles of digital notarizing. Though some platforms such as QuickenLoans have found ways to navigate this, the entire industry will need to adapt.

Years from the first steps leading to online mortgage lending, notarization faces similar challenges. Currently, states have a patchwork of laws, much like those that were initially governing online signatures. This dilemma raises some interesting questions. Is it legal to have a notary reside in one state & for parties living in another? Does the notary have to be in the same state as the signers? Like the case of online signatures, lenders fearing legal repercussions still find it safer to rely on physical documents to make sure that they are compliant with the law.

An Unforeseen Development

The current landscape of mortgage lending is far beyond what we would have imagined in the late ’90s. Now, a worldwide pandemic has pushed businesses either online or out of existence. Those that can adapt are those that can lend online. Many banks have based intense criticism for their lack of accommodations for their clients. Social distancing makes individuals wary of meeting in person, and hesitant lenders are sticking to the former status quo to avoid legal trouble.

Unfortunately, this puts many financial institutions at risk of falling behind. Clients are leaving their current banks for those that offer a better online experience. Even medicine has embraced telehealth to keep both doctors and patients safe. On the other end of the spectrum, finance has seen even more confusion from rushed legislation, leaving them unclear about how to comply.

The new way of life depends primarily on online interactions. Naturally, it would make sense that the remaining challenges in mortgage lending catch up with the times. In addition to the pandemic’s effect on how people go about their day-to-day life, millennials are reaching home-buying age and expect a fluid online experience. They will actively choose lenders and other services that provide a better and more coherent experience. Traditional lenders and those wary of migrating their services online despite the resources available are at risk of becoming obsolete in light of the coming change.

What’s Next in Online Mortgage Lending?

The final frontier for mortgage lenders is the legalization of digital notary services. While online mortgage lending has advanced by leaps and bounds over the last 20 years, this final obstacle between lenders and borrowers holds back a significant advance in how property purchases take place in the new normality.

The next change has to take place on a federal level. Mortgage lending, there must be one law unifying the requirements to notarize online. Following this, mortgage lending can join fintech in a wholly digital arena. While we wait for the legislation to come, prepare your staff and operations to embrace digital lending. When both businesses and individuals need more financial assistance than ever, lending must be there to give a helping hand.

Alternative Lending, Real Estate

For the first time in history, the value of oil dropped into the negatives in April. While it has recovered for now, some are predicting an incomplete recovery at best. In the greater context of post-COVID life, the safest investments will be green.

Construction has faced numerous challenges since the beginning of the pandemic. Supply-chain interruptions and rising costs of materials posed a unique set of issues to the industry. While new construction has ultimately slowed, the industry remains surprisingly resilient despite the struggles. Now, buildings are being designed for the next 100-year flu and a greener future overall.

What is driving the uptick in green construction? For one, it’s less risky overall. With uncertainty regarding fossil fuels, heating, air conditioning, and ventilation will have to become more efficient. Now that the virus’s spread is proven to increase in poorly ventilated areas, builders will have to rethink the tightly sealed construction that once made air conditioning more efficient.

Why Green?

For a safe return to the office, traditional construction will no longer make the grade. Not surprisingly, lenders are increasingly wary of offering to fund projects that cannot weather an uncertain future. Naturally, given the risk, both builders and lenders are looking towards the future through green-colored glasses.

Green construction companies are also on the rise. According to a report from The U.S. Green Building Council and Dodge Data & Analytics, 45% of those surveyed expected most of their projects by 2021 to be green construction. Given the additional push of the pandemic, those numbers could now be even higher.

New construction isn’t the only focus either. A significant amount of construction projects will include retrofitting older buildings with more environmentally-friendly fixtures. According to the same report, changes such as these will lead to a 13% decrease in operating costs over five years.

Lenders have been even warier of risk since the pandemic. In order to continue, they need to focus on construction that will be resilient during any future changes. Things will certainly not go back to how they were, but instead of lamenting, lenders must embrace the changes to continue moving forward.

To learn more about how Fundingo helps construction lenders adapt to the new dynamics of the pandemic, click here.