Lending Tips

Mortgage loan origination can be a complex and time-consuming process, but with the right strategies in place, it doesn’t have to be. In this article, we provide three essential tips for improving the efficiency of your mortgage loan origination process.

Utilize a Comprehensive Mortgage Loan Origination System

Leveraging a comprehensive loan origination system or LOS software to streamline the entire process is key. Not only will this empower your mortgage team to quickly and securely access, verify, and generate all necessary documentation, it will also provide complete visibility into the steps that have been completed, as well as access to up-to-date status reports. An LOS is customarily utilized to increase security, enhance accuracy and reduce time associated with delivering loan pre-qualification letters.

Utilizing an LOS allows your mortgage loan originators to easily access all relevant borrower data, leverage electronic signatures, enable secure document storage and effectively interact with automated underwriting system (AUS). And as an added bonus, this will also usually give them the ability to create a variety of custom letters and reports that can be shared with clients. By streamlining the disbursement process throughout each stage of the loan origination life cycle, mortgage lenders are able to more efficiently manage closing documents and procedures while eliminating time-consuming paperwork.

Implementing Compliance Expertise for Your Team’s Use

Having an experienced compliance expert on staff is essential for staying up-to-date on current regulations and guidelines pertaining to mortgage loan origination—it can be a daunting task for one individual to keep abreast of all the information. They must also remain updated on changes in policies and procedures, especially any rule changes that could affect the ability to approve or reject mortgage loan applications. In order to stay compliant, having an authoritative voice at all stages of the origination process is key.

With a full-time compliance expert part of the loan origination team, there will be an extra layer of security to help ensure accurate and reliable decisions. This professional can provide valuable insight on how to interpret rules and regulations, oversee procedures to guarantee compliance with signing documents and direct those who are responsible for verifying the customer’s eligibility. Compliance experts also monitor new regulative updates while keeping their team informed. This ensures that all application processes comply with guidelines, further increase the efficiency of mortgage loan origination.

Establish Clear Documentation Guidelines for All Borrowers

From collecting and verifying identification documents to obtaining financial statements and job records, establishing clear documentation guidelines for all borrowers is essential for efficient mortgage loan origination. Poorly organized paperwork can slow down the process, so it’s important to have a system for organizing borrower information and developing procedures that ensure compliance with all regulations. Additionally, if a lender does not have access to the proper documentation, they may be unable to approve or reject an application in a timely manner, ultimately leading to delays in the loan process.

To streamline the process and ensure uniformity in all documentation guidelines, lenders should develop a standard borrower profile. A template illustrating all required documents can provide borrowers with a checklist of items and help them determine exactly what they need to submit. All documents should also be organized and stored within a secure cloud-based system, so that employees have easy access to them when necessary. This will improve the efficiency of mortgage loan origination by providing bankers with quick access to the information they need to make an educated decision on whether or not to approve an application.

Leverage Automation for Higher Productivity

By automating various steps of the mortgage loan origination process, lenders can reduce time and labor costs. Automation can be used to streamline tasks such as gathering documents, managing compliance guidelines, and tracking loan application status information more efficiently. Additionally, leveraging automated solutions ensures that all processes are completed in accordance with regulations, helping to avoid compliance violations and costly errors.

Automation benefits front-office operations as well, such as creating more efficient pre-qualification letters for potential borrowers. Automated processing makes it easier for lenders to screen prospective borrowers quickly and accurately. Additionally, automated workflow processes can streamline certain day-to-day operations, such as receiving fee and commission information or self-regulatory initiatives. By investing in automation technology, lenders can devote more resources to closing deals and growing their customer base while simultaneously saving valuable time.

Have specific questions or want to talk to a FUNDINGO consulting expert?

Ready to Streamline Your Process? Get a FREE CONSULTATION Now!

Contact us at info@fundingo.com

Lending Tips

Over the past few years, numerous FinTech lending companies have emerged, calling themselves tech companies. SoFi, Lending Club, PeerStreet, Karna, and others have tried to ease the process. Yet even with the introduction of these digitized options, many lenders cease to adopt the new digitized features and instead continue to rely on the old-fashioned manual way. This way of doing business is not intrinsically wrong but it is not cost-effective and is prone to error. Also, clients seek a better experience that includes instant satisfaction and an engaged experience from the moment they apply for a loan all the way to paying for it.

Continuing to operate with spreadsheets or antiquated systems is a sure way to lose business and potentially acquire more risk than necessary. Also, in this economic climate making things more efficient is not a luxury but a must. When one considers the cost of one loan origination and/or servicing professional is close to six figures and that still does not account for oversight. On top of that, your throughput does not increase by adding more people but by automating tasks. Let’s take a look at what these tasks are and how to automate them.

Loan Management: The Solution

What will solve this aggravating issue for lenders? A loan management system. Before diving into the benefits of using a loan management system, let’s first take a look at what it is.

Loan management systems are applications that automate the processing and servicing of loans. In 2021, the global loan servicing software market size was valued at $2.3 billion, but by 2031, it is expected to reach $9.5 billion. It’s no wonder that, with digital transformation assuming a faster pace, loan management systems are rapidly being adopted.

Advantages of Having a Quality Loan Management System

Now that we have an idea of what a loan management system is, let’s break down three key benefits to using a quality loan management system.

Reduce the Effort

From closing, servicing to payoff, managing the loan servicing process takes a lot of effort. There’s boarding the loan, tracking the payments, having to send an alert for a payment reminder or a missed payment, and more. When you implement a robust loan management system, everything can be done automatically. So choosing the ideal modern system, where you can automate everything from payments to collection, makes the process seamless and quick.

Eliminate Human Error

When you use an efficient loan management system, everything, from payment to collection activities, is fully automated. Relying on this automation eliminates the possibility of transactions being recorded inaccurately and those careless human errors occurring. Customers will no longer have to worry about those pesky billing errors, and you won’t have to stress over losing business because of customers’ unhappiness. Relax and let the system take care of it.

Improve the Customers’ Experience

Utilizing a loan management system eases the process of onboarding new clients, managing payments, and keeping the communication line open. With an online portal that can be accessed at any time and payments being taken care of automatically, the whole customer experience is vastly improved and all parties are happy.

Since we have a clear idea of the benefits to using a modern loan management system, let’s take a look at five best practices to help expedite and manage loan applications and automate the financing and collection process.

Tips to Modernize Your Loan Management

- Streamline Loan Boarding

The process begins with loan boarding, and the tiresome procedure of manually entering and re-entering data can be exhausting. This is why it is important to streamline the loan boarding process and make sure all the data is seamlessly transferred from loan origination into loan servicing. Intuitive loan boarding easily populates loan terms and other important information for faster loan bookings, making this a better user experience and enhancing data consistency.

- Integrate Payments

Customers get tired of having to pay by wire or by check, so make this chore so much easier by giving them the option of having payments being taken out automatically. And, these payment gateways or ACH systems can be integrated directly into your loan management system.

- Simplify Decision and Approvals

When it comes to loan modifications or a request for a draw to be approved, customers become frustrated by having to wait long periods of time for a decision to come back. With a loan management system, the whole decision and approval process is quick and simple for all parties.

- General Ledger (GL) Automation

Accounting teams should no longer have to struggle to keep their accounting system up-to-date. With the use of a proper general ledger (GL) mapping that automatically generates transactions based on a predefined field mapping, the allocation of funds to the correct GL accounts can easily be done automatically. This mapping will help transfer GL data from the loan servicing system into your GL accounting software.

- Permit Self-Service

Customers love the option of self-servicing their loan. A loan management system provides them and investors with a portal where they can access their information, download statements, submit payments, request payoffs, and whatever other business may need to be taken care of.

Statistics are showing that, by 2024, institutions that provide a total digital experience will outpace their competitors by 25% in metrics for employee and customer satisfaction. With these benefits and tips to modernizing your loan management, why wait to take the first step? Sit down and strategically map out your process, then take note of any gaps, and finally, implement a system that includes the five tips presented in this article. Doing this will make the loan management process simple and painless for your employees and customers.

Interested in learning more?

Visit our website, www.fundingo.com, to see what FUNDINGO can do for you.

Have specific questions or want to talk to a FUNDINGO consulting expert?

Contact us at info@fundingo.com

Lending Tips

When considering the initiative to implement a new CRM for your business, it is always a good idea to consider the many factors that combine to form the “True Cost of Ownership”.

When most people think of the cost of ownership, they will often consider only the upfront price of the software or hardware and look no further.

However, this is not the whole story. Price alone does not take into account many of the harder to define but absolutely real costs associated with a CRM solution such as maintenance, support, training, user adoption, and efficiency. These costs apply not only to implementing a new system but also to keeping and maintaining a legacy system. When you add in all of these other factors, the true cost of ownership becomes clear, and it may be dramatically different than you expected!

Purchasing Cost

To illustrate the different factors, let’s take the example of purchasing, implementing and maintaining Salesforce. We begin with what people typically think of in terms of cost, the price. Of course, this is simply the price you pay to buy and use the software. The purchase here will be your Salesforce licenses and the products you are interested in, such as Sales Cloud, Service Cloud or Marketing Cloud.

Also, because Salesforce has so many different options and products available, the planning, research, and negotiation usually take a couple of weeks. The time and effort to do this should be factored into your purchase cost and may even include hiring a consultant to help you determine the best solution.

Additionally, your purchasing cost may include technology, such as new hardware or upgrades to existing hardware and software. Salesforce, being cloud-based, doesn’t have significant hardware costs, but then again we don’t recommend trying to run it with a 15-year-old computer. Altogether, any one-time purchase would be counted towards the purchasing cost of the technology.

As for legacy systems, the initial purchase cost is already in the past, however, similar to the above example, hardware or software upgrades may inevitably be needed to keep up with new tech or to keep the system functioning properly

Implementation Cost

Once Salesforce has been purchased, it needs to be set up and made usable. If your company already has a knowledgeable Salesforce Admin and doesn’t need a lot of customization, you may not need to hire an implementation partner. So your costs would be the time and effort.

However, if you are like most companies, you will want to take advantage of the Salesforce and its tools to the fullest, and won’t have enough knowledgeable folks on staff to enable this, so you will need to hire a consultant/implementation partner. Costs here can vary and depend on how much custom development you need and what solutions the consultant recommends.

Additionally, as a part of implementation you should include the cost of training users on the new technology and the changes in both short-term and long-term efficiency. Most companies who implement a new CRM see a dip in efficiency right away, but overall, they see long term improvements as the employees get the hang of things and in many cases with Salesforce, the day to day processes become significantly more efficient down the road than they were before adopting the CRM.

This is also why choosing the right CRM is important, because if you have poor user adoption, you may not realize the improvements you need to grow your business.

Legacy systems, on the other hand, have implementation costs pretty much only around training of new users. However, the older the system and tougher it is to use, the longer and more challenging this can be, leading to an extra cost in time and effort.

Support & Maintenance Cost

Finally, when considering the true cost of CRM ownership, we turn to the support and maintenance cost. If you have gone with a cloud CRM like Salesforce, you do not have to worry about updates, upgrades and bug fixes, they will all be taken care of. But you will, of course, have to pay Salesforce a monthly fee for that service. If you have a local CRM but a support plan from the developer, that will also be a recurring fee, or if you have a local CRM, built in-house, then you will have costs associated with IT staffing and overhead.

Other support costs that may come into play are support contracts with external vendors, ongoing licenses and the potential costs of adding new features or enhancements. In the end, these all add up to allowing you to scale (or not). If you have a flexible system that can change and grow with you, you will be able to minimize many of these support costs down the road. However, if the system doesn’t have that ability, then your support and maintenance costs will grow significantly down the road, and may eventually force you to replace the whole system.

Final Cost

The True Cost of CRM Ownership needs to be measured not just in how much the immediate system, products and training costs, but also in future costs. How much will a poor system slow you down? How much will a poor system prevent you from growing? Will you get left behind by not upgrading?

So, when it comes to evaluating the true cost of CRM ownership, sometimes a system with a larger up front price tag, will actually cost less in the long run when you take the other factors into consideration.

Salesforce is a great example, because while the system is admittedly not the cheapest option on the market, it can help you save money down the road due to high rates of user adoption, more efficient processes and simply put, if you get it set up right the first time, you will likely never need to buy and implement another CRM again.

No matter which direction you choose to go with your CRM, proper planning or budgeting, using all of the above criteria, will help you out significantly. Nobody wants to spend a lot of money on a system that they outgrow in a couple of years, and by taking into account the various factors of purchasing costs, implementation cost and support cost, you will be able to get a better idea of how to spend your money and make sure you get a solution that fits your short term as well as long term needs.

Interested in learning more?

Have specific questions or want to talk to a FUNDINGO consulting expert?

Contact us at info@fundingo.com

Lending Tips

Financial experts are debating whether or not the US is entering a recession. While the jury is out, many companies have already started cutting down on their workforce and investments in

preparation for hard financial times.

It is important to highlight that businesses usually start investing as soon as three months after a recession ends. However, on average, it takes more than two years to reach the pre–peak level of investment. And more recent recoveries have seen weaker investment growth post-recession. Because of this, many successful companies and investors use crises to invest and to prepare for the future, and they do this by acquiring technology, especially enterprise solutions that will help streamline your core business processes, such as lending.

Minimize expenses, maximize profits

According to the results of the 2022 KPMG U.S. Technology Survey Report, companies that invest

in technology see a “strikingly strong ROI” with 21% of respondents reporting a 11%+ increase in profitability and 36% reporting a 6-10% increase. A boost like this is compelling whether we’re in a

recession or not, but it becomes even more important during a crisis since investing in technology, especially enterprise technology can also lead to cutting costs in the workforce, redundant IT tools, and shortening sales cycles.

In addition to the profits increase that can be measured in the short to mid-term, there are other mid to long-term benefits to investing in technology during tough financial times. Among these are a stronger brand, market differentiation, and business strategy advancement. As reported in the aforementioned KPMG survey, 66% of respondents have been very or extremely effective in using technology to advance their business strategy.

Exploit the downturn to your advantage

Technology companies are not immune to financial crises, and this is good news for any organization looking to invest in technology that will enable them to be more efficient, cut costs

and provide a better customer experience. This is especially true in the lending industry where processes tend to be manual and labor intensive, and where there are many opportunities for gained efficiencies.

In lieu of a financial downturn, tech companies of all sizes and regardless of how strong their balance sheet is, are taking a series of steps to make it to the other side of a recession. This includes firing executives with borderline performance, reducing workforce, cutting low performing products or business units, and more importantly for us here, many will rectify the cost of their products and services while keeping up quality and their value proposition.

What does this all mean to you? It means that your organization could potentially get the same products and services for a significant lower investment. In fact, technology companies are likely to streamline their processes to deliver a better and more affordable product during a downturn. It is also worth noting that technology (including enterprise solutions), are driven by economies of scale so the more you buy, the cheaper it gets, especially when prices are adjusted during a recession.

Say goodbye to IT and its high cost

If you have a local system at your company, you need to have a reliable IT team to keep things running smoothly. This team is in charge of a number of essential tasks, including:

- Software installation and updates

- Managing information security and privacy

- Hardware maintenance and upgrades

- Routine backups with redundancy across locations

- Tech / user support

By acquiring a cloud-based solution you can save on costly IT resources, and often drastically reduce or even eliminate the need for an IT team. With a cloud-based platform, you simply need

an Internet connection to conduct business and you don’t need to incur in expenses related to hardware and software updates, and the issues that come along with maintaining an IT system.

Without investment there are no productivity improvements

As a result of the last few recessions, top-performing companies and organizations have realized that by halting investment in people, process improvement, and technology, no new wave of productivity improvement is possible. On top of that, they have realized that most of the technology solutions available today are mature, secure and affordable — and definitely much better than the technology it replaces. In addition, the lending industry following suit in many others, has realized that software-as-a-service (“SaaS”) solutions perform better than traditional technologies.

Improving productivity in times of financial crises cannot be accomplished by increase in workforce or by changing the way processes work. The best bet is in the use of technology to minimize manual, repetitive tasks and to maximize throughput. Furthermore, technology also improves the processes and tasks related to quality control and risk management, and in many cases eliminating human error and the need for quality checks entirely.

Treating technology as a cost is an old school concept

It may seem like the times when CEOs and CFOs treated technology investment as a cost. This viewpoint has preserved an older set of technologies that weren’t built for current times. According to the MuleSoft 2022 Connectivity Benchmark Report, an average of 70% of total customer interactions are digital and companies that are not ready will be left behind by the marketplace, especially during a downside economy where clients are looking for value, efficiency, and great customer experience.

In today’s interconnected world, adopting cloud-based solutions is not a choice but rather a requirement. A requirement to stay atop of the competition and a requirement by customers hungry for streamlined and easy experiences when interacting with any company, regardless of the product or service. According to the Connected Small Business Report by Deloitte, digitally advanced businesses experienced 4X the growth than less digitally advanced businesses. What this tells us is that, if an organization is to have better chances to go through a recession successfully, technology investment is a strong and sound decision.

In Summary: Innovate or risk falling behind

If it takes at least 2 years to recover from the lack of innovation and investment due to a recession, it makes financial sense to continue to innovate during a financial crisis, especially if there are many other benefits such as the lower costs of acquiring technology and the ensuring a great positioning of your business while most others are contracting.

The lending industry is one of the most immediately affected by a recession, and therefore it is one where competitors will either close down or halt investments. This is your time to make good use of the recession and differentiate your brand from the competition.

Interested in learning more?

Visit our website, www.fundingo.com, to see what FUNDINGO can do for you.

Have specific questions or want to talk to a FUNDINGO consulting expert?

Contact us at info@fundingo.com

Lending Tips

Underwriting Software is Essential for Lenders

An efficient underwriting process is essential to every type of lender. It ensures that applications are processed quickly, risk is evaluated adequately, and prices and terms are set to maximize profit and minimize exposure. Without a sound, automated underwriting process in place lenders struggle to grow profitably and remain competitive.

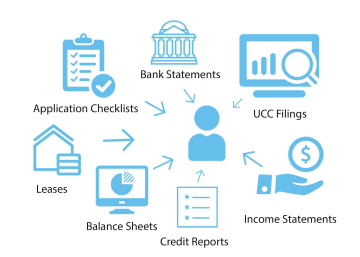

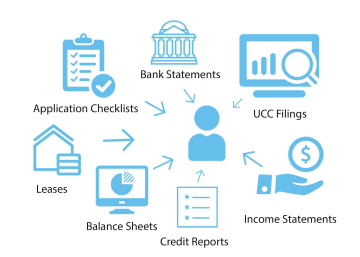

Yet many lenders rely on an inefficient and manual underwriting process. Data and documents are pulled from a variety of sources but not stored in a central location, making it difficult to access and use. Credit reports, bank statements, income statements and balance sheets, leases, and other important documents are all in separate places, making it difficult for underwriters to keep track of them. On top of this, manually performing underwriting tasks is inefficient and prone to human error.

Before speaking of benefits, it is important to highlight the importance of selecting a loan management system that is built-for-purpose and designed with ease-of-use in mind. A purpose-made system helps increase client satisfaction, makes processes significantly more efficient, and serves as a force-multiplier. All of these attributes result in cost-savings and higher profits, but the benefits of a well-designed loan management system do not stop there; it also enables lending teams to perform their tasks intuitively without having to go through a painful learning process.

At its core, a robust loan management solution endeavors in minimizing manual tasks and automating repetitive actions. This includes documentation management, decisioning, reporting, and communications, which require flexible workflows and many times interconnectivity with other systems. However, in the world of software there always are legacy solutions, and in the case of loan management solutions these often lack connectivity with other systems (e.g., payment processing, general ledger, etc.), have rigid workflows that require lenders to adapt to the system rather than the other way around, and are difficult to adopt by less technically-savvy users.

The Costs of a Broken Underwriting Process

By relying on a disjointed underwriting process with vital information scattered in various places, lenders create for themselves several costly problems, including:

- Inefficiencies and delays

- Inaccurate data and higher risk

- Inconsistency processes and lack of control

- Poor customer experience

Inefficiency and delays: A patchwork process slows down underwriting, making it difficult to respond promptly to prospective borrowers. Given that most borrowers submit applications to multiple lenders and expect a rapid response, delays mean that opportunities are lost to competitors. Borrowers won’t wait.

“For bank loans and loans backed by the Small Business Administration, for example, it’s common to wait 90 days before you receive an initial response… if you’re applying for a merchant cash advance, you might hear back within just a few hours.” – Funding Circle

Inaccuracy and higher risk: A disjointed underwriting process that stores information in multiple systems is vulnerable to oversights and inaccuracy. Important information can get lost or overlooked. Without complete and accurate information at hand, lenders are likely to miscalculate the risks of certain loans or set inappropriate terms and conditions.

Inconsistency and lack of control: When underwriters work with a patchwork system, it is difficult to enforce standards for underwriting across the portfolio. Each loan application may follow a different underwriting process, or the standard may vary from one application or one underwriter to the next. Without a means to enforce underwriting standards, there’s a lack of consistency and control.

Poor customer experience: Customers expect a seamless experience that provides real-time feedback to remain engaged. A manual, inefficient underwriting process is slow and prone to errors and it results in clients that have to wait days-on-end to receive feedback or a resolution on the loan they eagerly expect to get. Inefficient lenders tend to lose clients to other institutions with automated underwriting that includes tools clients appreciate and converts them into loyal customers. Also, underwriting automation enables clients to provide all details and documentation through an automated portal that triggers the underwriting process and keeps them in the loop for additional details and documentation needed. In the end, successful lenders are perceived as trustworthy and that is associated with technology.

Each of these problems created by a poor underwriting process directly affects an alternative lender’s ability to grow profitably. Lenders ignore them at their peril. The problems won’t go away by themselves and will become more acute over time. Decisive action is required to fix the process.

Better Solutions are Available

Fortunately, remedies are available that replace the inefficient, disjointed, and risk-prone systems that many alternative lenders rely on. These better solutions support a more effective underwriting process.

Benefits of an automated solutions include:

- Centralized Information

- Standardized Processes

- Automated Pricing

- Integration of Data Sources

Establish a single source of truth: New systems make all information relevant to each loan application easily accessible, not spread out over multiple systems. Centralizing the information makes the process more efficient and more accurate. Documents aren’t misplaced, information isn’t manually transferred from one place to another, and applications are processed more quickly. The result is that applications are assessed more accurately and more are converted into deals.

Establish a Standard Process: The new underwriting software supports greater consistency and reduces risk. All applications are reviewed via a standard workflow. This ensures that all required elements are accounted for. Missing information is flagged, stips are specified, and requests for more documentation are automatically sent to applicants.

Automated Pricing: New underwriting software can automatically calculate pricing and terms for each deal, following established guidelines. This ensures greater consistency in developing offers and maintaining standards.

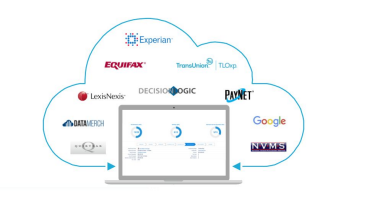

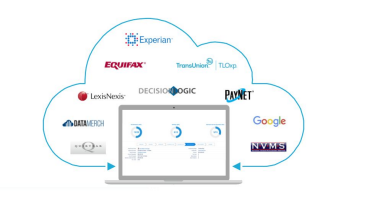

Streamlined Data Source Integrations: No underwriter can do their job without data to verify and manage risk. A quality system will seamlessly integrate sources of borrower verification data, such as LexisNexis, Experian and DecisionLogic. Essential information can be automatically added to application records or run through a series of workflows to evaluate risk.

Selecting an Underwriting Software

As lenders of all types consider more advanced solutions to support their underwriting process, they should consider several key criteria in addition to particular features and functions.

Work with a proven solution: Lenders should get the benefit of an underwriting software that’s been successful with other lenders. They don’t want to be working with a vendor or a system that’s not been proven in the real world.

Select a solution built on a reliable, accessible, and secure platform: Because underwriting is essential to the lending process, lenders need a solution that’s always available and can be accessed from anywhere on any web-enabled device. The system should also ensure that all data is secure. A proven platform, such as salesforce.com, would meet these standards.

Allow for configuration: Because each lender may have developed its own particular process for underwriting, they should select software that can be configured to fit their own process. It should be easy to build workflows and establish standards that suit each lender. They should avoid a “one size fits all” solution that forces lenders to adjust their process to fit the system.

Supported by lending experts: For lenders considering better software to support underwriting should assess the background and expertise of the people who have built and support the solution. The solution and team behind it should understand the unique needs of each lender, whether you’re an alternative lender or not, seek for a solution built from the ground up to meet requirements of lenders in your space.

About the FUNDINGO Loan Management Solution

FUNDINGO is a loan management solution designed for small business, alternative, real estate and CDFI lenders. It streamlines the entire process of originating, underwriting, and servicing loans.

Unlike a hodge-podge of outdated and unconnected systems, each handling only a single element in the lending process, the FUNDINGO solution helps lenders attract and close more deals, accelerate the underwriting process, generate more pricing options, reduce errors, and ensure greater consistency. These lenders also earn a more professional reputation among borrowers, brokers, and syndication partners.

The FUNDINGO solution is built on the salesforce.com platform and can be closely integrated with a company’s CRM, finance, document management and other systems. The solution is supported by experts in lending loan management and has been successfully implemented in leading firms across the U.S. Contact us to learn more about how Fundingo can help standardize your processes.

Lending Tips

The lending market is highly competitive and fast-paced, and no matter the size of the lender or the types of products, increasing profits and outdoing the competition is what leaders in the lending industry constantly strive for. Automation is one of the most intelligible means to gain a competitive advantage, lower cost, and scale a lending business rapidly.

Before speaking of benefits, it is important to highlight the importance of selecting a loan management system that is built-for-purpose and designed with ease-of-use in mind. A purpose-made system helps increase client satisfaction, makes processes significantly more efficient, and serves as a force-multiplier. All of these attributes result in cost-savings and higher profits, but the benefits of a well-designed loan management system do not stop there; it also enables lending teams to perform their tasks intuitively without having to go through a painful learning process.

At its core, a robust loan management solution endeavors in minimizing manual tasks and automating repetitive actions. This includes documentation management, decisioning, reporting, and communications, which require flexible workflows and many times interconnectivity with other systems. However, in the world of software there always are legacy solutions, and in the case of loan management solutions these often lack connectivity with other systems (e.g., payment processing, general ledger, etc.), have rigid workflows that require lenders to adapt to the system rather than the other way around, and are difficult to adopt by less technically-savvy users.

Key Benefits of Automated Loan Management Systems:

Automation empowers users to perform value-add tasks rather than spending countless hours in manual, low-value, and manual tasks, but it also offers key strategic benefits that we outline in this piece. So, let’s take a look at how you can leverage the power of a loan management solution:

1. Simplified loan management processes

Every loan originated is the result of a collection of countless data points and a long list of documents that need to be scrutinized in order to make sound decisions and to ultimately approve or deny any given loan. Traditionally, lenders perform a series of complicated and time-consuming tasks to originate and underwrite a loan; in contrast, a loan management system can filter out unqualified applications, automate document gathering, pre-input data points, and complete underwriting in minutes.

When it comes to loan servicing, not all loans are created equal! A flexible yet robust loan management solution supports variations of loan products, even within the same industry and even within the same organization. Servicing a loan becomes a matter of making strategic decisions rather than a series of manual tasks to just stay afloat. Speak of a simplified loan management process!

2. Reduces costs and increase profitability

The cost of a robust loan management solution may seem significant; however robust systems are a powerful force-multiplier that show great return of investment (ROI) in as little as one year, and more importantly are a driving force in reducing long term cost of operation. For instance, rather than hiring additional staff to process a higher volume of loan applications, a loan origination and underwriting system enables you to automate manual tasks like document collection, decision making, and closing documentation; all of which result in both a higher volume of loans and more profits without having to increase headcount.

Speaking of higher yields, a great loan management system will help you streamline the invoicing and payment processes that directly will impact your bottom line by making sure all payments are processed correctly and timely. In addition, more advanced platforms will give you the ability to easily manage and make sure that you are collecting applicable fees, such as late fees, early payment fees, and other loan servicing fees.

3. Better customer relations

The three major factors that affect customer satisfaction are customer understanding, service, and technology. What is great about a mature loan management solution is that it can positively affect all three.

Let’s start with understanding. A big part of customer understanding is about preferences, in this case some clients prefer looking at their balance online, others via phone, or perhaps a text message. Online retailer Zappos, one of the most “customer-happiness” obsessed companies ever, understands that catering to customers preferences is key to earning customer loyalty.

Now let’s look at service, which is the most misunderstood concept in any industry, and lending is not the exception. Service is not only about someone ready to talk to you over the phone to make concessions. Think about Amazon for a minute, they understand that convenience is offering a wide range of products delivered to your doorstep faster than anyone else. In the lending world convenience may mean a seamless loan application or a text with a link to pay my loan every time it’s due.

Lastly, technology. This is the easy part when discussing benefits of a great loan management system. Nowadays, clients would rather check their balance online than opening a mailed statement. Who wants more envelopes in the mail?

4. Better Tracking and Transparency

Not only transparent and reliable information is a key benefit of a loan management system but it also serves as a significant selling point to investors and board members. A mature loan management system provides total and real-time access to data points of all vital parts of the business, including performance metrics.

A modern loan management system also offers ways to make sense of all data points by offering customizable dashboards that can be tailored depending on the audience and reports that can be easily modified and shared on the fly.

Also, tracking performance data in a systematic way allows executives to more quickly identify areas of concern, risks, and ultimately empowers them to make better decisions. In addition, centralizing all reporting and metrics in one system makes inter-departmental collaboration easier and more efficient.

The FUNDINGO Loan Management Solution

Ready to reap the benefits of a sophisticated loan management system? FUNDINGO is a loan management solution that can help you streamline your entire process of originating, underwriting, and servicing loans.

The FUNDINGO solution is built on the salesforce.com platform and can be closely integrated with a company’s CRM, finance, document management and other systems. The solution is supported by experts in alternative lending loan management.

Contact us now to learn more about how FUNDINGO can help you make better decisions and grow your business.