Lending Tips

An efficient underwriting process is essential to alternative lenders. It ensures that applications are processed quickly, risk is evaluated accurately, and prices and terms are set appropriately. Without a sound underwriting process in place, alternative lenders struggle to grow profitably and succeed.

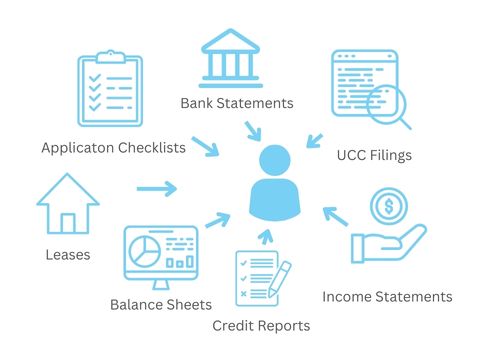

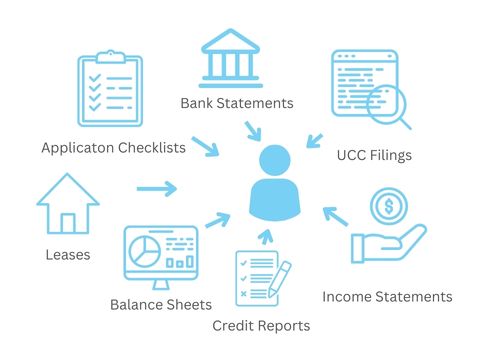

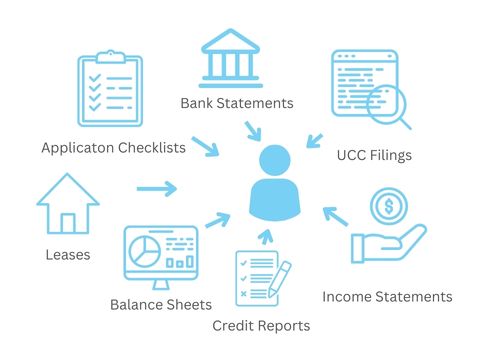

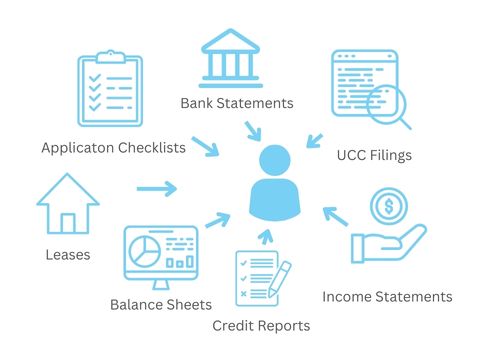

Yet many alternative lenders rely on an inefficient, patchwork underwriting process. Data is pulled from a variety of sources, but not stored in a central location, making it difficult to access and use. Credit reports, UCC filings, bank statements, income statements and balance sheets, leases, and other important documents are all in separate places, making it difficult for underwriters to keep track of them.

Underwriters must collect data from multiple sources.

The Costs of a Broken Underwriting Process

By relying on a disjointed underwriting process, with vital information scattered in various places, lenders create for themselves several costly problems.

| The Cost of a Broken Underwriting Process |

| Inefficiencies and delays |

| Inaccurate data and higher risk |

| Inconsistency processes and lack of control |

Inefficiency and delays: A patchwork process slows down underwriting, making it difficult to respond promptly to prospective borrowers. Given that most borrowers submit applications to multiple lenders and expect a rapid response, delays mean that opportunities are lost to competitors. Borrowers won’t wait.

“For bank loans and loans backed by the Small Business Administration, for example, it’s common to wait 90 days before you receive an initial response… if you’re applying for a merchant cash advance, you might hear back within just a few hours.”

– Funding Circle

Inaccuracy and higher risk: A disjointed underwriting process that stores information in multiple systems is vulnerable to oversights and inaccuracy. Important information can get lost or overlooked. Without complete and accurate information at hand, lenders are likely to miscalculate the risks of certain loans or set inappropriate terms and conditions.

Inconsistency and lack of control: When underwriters work with a patchwork system, it is difficult to enforce standards for underwriting across the portfolio. Each loan application may follow a different underwriting process, or the standard may vary from one application or one underwriter to the next. Without a means to enforce underwriting standards, there’s a lack of consistency and control.

Each of these problems created by a poor underwriting process directly affects an alternative lender’s ability to grow profitably. Lenders ignore them at their peril. The problems won’t go away by themselves and will become more acute over time. Decisive action is required to fix the process.

Better Solutions are Available

Fortunately, remedies are available that replace the inefficient, disjointed, and risk-prone systems that many alternative lenders rely on. These better solutions support a more effective underwriting process.

| Benefits of An Automated Solution |

| Centralized Information |

| Standardized Processes |

| Automated Pricing |

| Integration of Data Sources |

Centralize all information: New systems make all information relevant to each loan application easily accessible, not spread out over multiple systems. Centralizing the information makes the process more efficient and more accurate. Documents aren’t misplaced, information isn’t manually transferred from one place to another, and applications are processed more quickly. The result is that applications are assessed more accurately and more are converted into deals.

Centralizing all data makes the process more efficient and accurate

Establish a Standard Process: The new underwriting software supports greater consistency and reduces risk. All applications are reviewed via a standard workflow. This ensures that all required elements are accounted for. Missing information is flagged, stips are specified, and requests for more documentation are automatically sent to applicants.

Automated Pricing: New underwriting software can automatically calculate pricing and terms for each deal, following established guidelines. This ensures greater consistency in developing offers and maintaining standards.

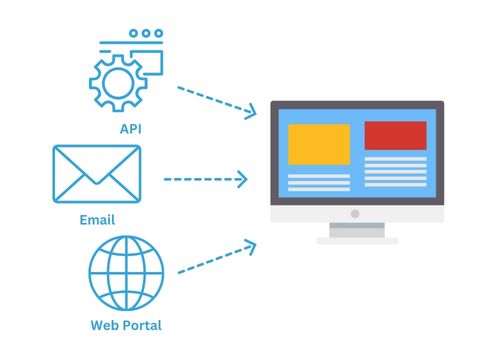

Streamlined Data Source Integrations: No underwriter can do their job without data to verify and manage risk. A quality system will seamlessly integrate sources of borrower verification data, such as LexisNexis, Experian, and DecisionLogic. Essential information can be automatically added to application records or run through a series of workflows to evaluate risk.

Selecting an Underwriting Software

As alternative lenders consider more advanced solutions to support their underwriting process, they should consider several key criteria in addition to particular features and functions.

| Key Characteristics of an Automated

Underwriting System |

| Proven Solution |

| Reliable, accessible platform |

| Configurable |

| Expert Support |

Work with a proven solution: Alternative lenders should get the benefit of an underwriting software that’s been successful with other lenders. They don’t want to be working with a vendor or a system that’s not been proven in the real world.

Select a solution built on a reliable, accessible, and secure platform: Because underwriting is essential to the lending process, lenders need a solution that’s always available and can be accessed from anywhere on any web-enabled device. The system should also ensure that all data is secure. A proven platform, such as salesforce.com, would meet these standards.

Allow for configuration: Because each alternative lender may have developed its own particular process for underwriting, they should select software that can be configured to fit their own process. It should be easy to build workflows and establish standards that suit each lender. They should avoid a “one size fits all” solution that forces lenders to adjust their process to fit the system.

Supported by alternative lending experts: Alternative lenders considering better software to support underwriting should assess the background and expertise of the people who have built and support the solution. The solution and team behind it should understand the unique needs of alternative lenders. The solution should have been built from the ground up to meet their specific requirements. A “generic” lending solution, adapted from a different market, is unlikely to properly address the needs of the segment.

About the FUNDINGO Loan Management Solution

FUNDINGO is a loan management solution designed specifically for alternative lenders. It streamlines the entire process of originating, underwriting, and servicing loans.

Unlike a hodge-podge of outdated and unconnected systems, each handling only a single element in the lending process, the FUNDINGO solution helps alternative lenders attract and close more deals, accelerate the underwriting process, generate more pricing options, reduce errors, and ensure greater consistency. These lenders also earn a more professional reputation among borrowers, brokers, and syndication partners.

The FUNDINGO solution is built on the salesforce.com platform and can be closely integrated with a company’s CRM, finance, document management and other systems. The solution is supported by experts in alternative lending loan management.

Lending Tips

6 Factors to Consider When Measuring Software Return on Investment (ROI)

Software purchase is an integral part of the alternative lending finance industry in order to maximize profits and fund more loans quickly. However, great software can easily become very expensive. So before investing in a loan management solution, you must consider ROI.

Why Calculations and Measurement are Important

Given the high cost of software, it is imperative to get an attractive return on investment (ROI) on its purchase. You want to be confident that your company is investing money in the right coffers. Hence, you must make fail-proof estimates to convince your company’s stakeholders. Read this guide to learn how to accurately gauge and measure loan management software ROI for your company or business’s sake!

But What is ROI?

We’ve been going on about software ROI, but what does it entail? Let’s break it down for you. A return on investment (ROI) is an essential metric in the finance and investment industry. It is a calculation that details an investment’s cost compared to its benefit.

Calculating ROI

The good thing is that ROI has the same general formula no matter the type of product or investment involved. And this straight-to-the-point formula is:

ROI = (Gain of Investment) – (Cost of Investment)/ (Cost of Investment)

Here is a simple explanation of the mathematical components:

Gain of Investment — This refers to the potential amount of money you may derive from the software investment.

Cost of Investment — This refers to the money and expenses incurred in purchasing, implementing and maintaining your software.

Factors that Impact Software ROI

Measuring software ROI is not an easy feat. It may be not easy to quantify the exact amounts involved. For instance, you may find it challenging to calculate productivity benefits and losses. Because let’s face it, the time taken to install and learn the mechanics of new software is a productivity loss. But thankfully, there are specific considerations that simplify the calculations. These include but are not limited to:

Efficiency — You need to take stock of the product’s functionality. Will it allow your staff to complete more tasks at a faster rate? Will the package features reduce cost compared to the old installation?

Scalability — This considers the software’s long-term growth to your company’s growth. Will the product serve the company’s needs as the company progresses and expands? Your answer will determine if the software is a good investment or not.

Security — You need to consider if the product has exemplary security configurations. You don’t want a security breach that can compromise your system. So, If you make the mistake of working with a product that defies security considerations, it can cost your company a lot.

Training — A software company that offers training services to its clients is a much better investment than one that doesn’t. You should also consider the onboarding process for your employees and how it directly affects ROI.

Integrations — Is the software compatible with your existing programs and platforms, such as marketing automations and CRMs? In cases where a software product is not easily integrated, you may have to spend more money. So, think about how this will impact ROI!

The Takeaway

Measuring software ROI can be as easy as following this guideline! A right step in the wrong direction can have severe consequences. But a right step in the right direction can birth huge software ROI.

Lending Tips

When it comes to the loan origination process, every firm uses its own unique procedure. From the software used to the quality control steps an organization requires before funding, each uses a process that works for its own needs and the needs of the clients they serve. When looking at the origination lifecycle from a holistic perspective, it is vital to evaluate all possible standpoints.

Even though each loan origination process differs, they all follow seven distinct steps that comprise the entire loan origination system. Each of these seven steps is critical to an overall process that appropriately functions.

Stage 1: Pre-Qualification

At the pre-qualification stage, the borrower will receive a list of items needed to compile and present to the lender to move forward with the process. The list of items a borrower needs to present includes:

- Information about present employment, including the hourly pay, annual salary, and overall average earnings

- Payment history

- Bank statements

- Tax returns

After providing the paperwork, it will normally undergo processing, after which the institution will generate a loan pre-approval. The application of the prospective borrower will proceed through the loan origination system.

Stage 2: Loan Application

The borrower is responsible for filling out the loan application at this point in the process of the loan origination system. New technologies made possible by loan origination software allow for successful registration online and through a smartphone app. You can then use the data to fit particular loan management requirements.

Stage 3: Application Processing

The application gets reviewed for consistency and completeness after being received by the credit department. A smart loan origination system or LOS can automatically indicate files without the necessary data and return them to the borrower.

Benefits of a Smart Loan Origination System

A smart, high-quality Loan Origination System can provide the following:

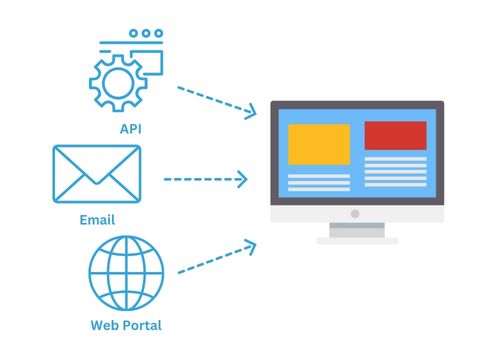

- Multiple-channel application receipt

- Online bureau reports

- Credit score calculations

- Promotions like lower rates or no interest for a time

- Automatic or manual credit choices

- Individual application rescoring

- Automate decision-making

- The real-time data link between origination, funding, and servicing

- Customize underwriting workflow

- Status, dealer, user, or underwriter-based application reports

Stage 4: Underwriting Process

During the underwriting process, the lender reviews the application based on several factors. Many firms developed supplementary scoring standards particular to their firm or industry.

Stage 5: Credit Decision

The underwriting procedure of the loan management will determine whether the application gets granted, denied, or returned to the applicant.

- Granted: The application is granted pending approval through the quality control process.

- Denial: If specific conditions alter, such as lowering the loan balance sought or adjusting interest rates to lower payments.

- Sent back: Request for more details.

Stage 6: Quality Control

Lenders put significant effort into the quality control phase of the origination system process. Here, the application gets delivered to a quality control channel where you can assess a conclusion and other crucial factors compared to domestic and foreign policies and standards.

Stage 7: Loan Funding

Consumer loans begin to pay off soon after the loan agreement gets finalized and signed. A robust loan origination software can monitor financing to ensure that the required paperwork is signed before or concurrently with the loan management process.

Conclusion

Loan applications can be a long process. Luckily, loan management software is now available. This software makes the application process and the loan processing itself a lot easier. Contact Fundingo today to get the best software possible for your firm!

Lending Tips

Top 4 Features of a Mortgage Lending Software Solution

The worldwide lending market is expanding at a tremendous rate with a compound annual growth rate of 13.5%. However, one can become overwhelmed when looking at loan servicing software options. A unified platform is often the ideal solution for enterprises with various point solutions or those looking for a better way to create new loan products.

Traditional loan portfolio management methods, such as manually tracking each borrower’s progress from application to repayment, are a thing of the past.

With that, each of the following top features delivers or contributes to concrete benefits for mortgage lending institutions:

1. Automation

With automation, lenders can make informed judgments by smoothly integrating third-party technologies and vendors, bringing all the necessary components to the table to reduce turnaround times and errors.

Moreover, automating the lending process reduces procedures that cause delays in loan origination software because they rely on manual inputs.

2. Mortgage Loan Application Management

For the most part, customers would rather not deal with person-to-person transactions during the origination process. The option to apply for a loan online continues to grow in popularity with almost two-thirds of loan applicants using online services to fill out at least a portion of their loan applications. Good thing that it is now possible to complete the full mortgage origination process from the comfort of your own home, thanks to new technology. Lenders and borrowers can use this self-service channel to keep tabs on and manage their existing loans, making mortgage loan application management a breeze.

3. Loan Origination, Underwriting, and Servicing

Origination, underwriting, and servicing are currently the greatest hurdles for any lender. These procedures need considerable time. In addition, they require extensive human and analytic resources and are also the most prone to errors and liabilities.

Digital underwriting is no longer an option in the mortgage industry; it is a must with even the FHA using digital underwriting. Today, digitally automated loan underwriting is a typical approval method. With the most recent loan underwriting software, the borrower need only submit the required documents to the system to receive an almost instantaneous response.

A user-friendly, AI-powered platform for loan servicing automation can streamline lenders’ loan servicing processes. Using loan servicing software can assist in reducing the burden on lenders, underwriters, and borrowers by eliminating the need for tedious manual processes. Ultimately, lenders may provide great customer care to all consumers if they speed up the lending procedure.

The best mortgage loan software integrates loan origination, underwriting, and servicing. Additionally, it is essential to have a scalable system that meets your needs.

4. Reports and Dashboards

You can gain valuable insight into your customers by collecting data about them. A good loan origination software must be able to track your customers and their loan progress when they utilize it. Using this data, the lender’s choice of software should examine the app’s performance, reasons for competitive losses, and frequent challenges borrowers have during the origination process, among other information.

Using this data, you can shorten the time it takes to process an application, increase the number of applicants, and improve customer satisfaction.

Conclusion

The initial cost of investing in advanced lending software may be substantial, but the return on investment is far larger when the process gets carried out correctly. Examine how Fundingo can assist you.

Lending Tips

Community Development Financial Institutions, or CDFIs, provide loans to individuals, families, and small businesses. These innovative, inclusive lending programs are helping underserved urban and rural areas one loan at a time. CDFIs can effectively serve their clients and communities if they have the necessary operational and communication tools. One of those essential technologies is loan servicing software.

What is a CDFI Loan Management System?

A CDFI loan management system automates the loan lifecycle, from application through closing. Traditional loan management entails gathering and confirming applicants’ reliability and reputation.

Loan management systems automate these processes and offer lenders and borrowers relevant statistics and insights.

Benefits of Having a Loan Servicing System

Loan servicing software that utilizes automation and machine learning can complete numerous basic operations more quickly and accurately than human labor.

With that, the benefits of a CDFI loan servicing system include:

Automated Reports

Digital CDFI loan servicing software generates automated reports. Regulatory bodies, borrowers, and investors request accounting, tax returns, and invoicing. Loan servicing software allows lenders to create and submit these reports swiftly.

Prevent Payment Delays

Using a CDFI loan management system, lenders will never have to be concerned about collecting debts in a timely manner. Loan servicing systems include analytical modules that can identify slight changes in client credibility and prevent payment delays.

Loan Servicing Automation

Although loan servicing companies handle most of your loan management needs, automating as many processes as feasible is still beneficial. Organizations that employ automation well can spend more time on client communications, which require more staff control.

Eliminate Human Error

Too many variables make lending error-prone. A great loan servicing software, on the other hand, is designed to eliminate any faults, which is unquestionably useful from every angle.

The Top 7 Features

Not all loan servicing software is the same. While some companies provide a combination of services, others offer a full, comprehensive loan servicing system.

Here are seven features to look for in a CDFI Loan Servicing System:

Draw Management

It is key to CDFI loan management to efficiently manage draws while making the process easy for your team and borrowers. Look for features that track relevant information such as property, inspection, photos, and cost; maintain an organized understanding of financial transactions in line with the budget with an overview of borrower disbursements and payments; track draw reserve balances; and manage and approve draw requests.

Loan Portfolio

Key to CDFI management is the ability to track and manage loan portfolio activity for informed decision making. A loan management solution should be able to monitor active deals, how many deals are approaching maturity, and what draws are outstanding, so that you can identify issues and maintain compliance.

Reports and Dashboards

Made up of components that organize visually represented data from reports (and can feature forms such as graphs, tables, charts), dashboards and reports are a powerful way to visualize key metrics. They provide high level overviews of your most important data and are essential tools that can provide chosen information at a glance. By connecting key data to your dashboard, staying informed on essential information can be done with ease.

Refinance & Renewals

Maximizing renewal revenue and refinancing loans should be effortless. Loan management solutions should include the necessary tools to manage renewals, decrease errors when refinancing, and track eligibility for renewals.

Interest Accruals

Know what interest is accrued when. Automations should include term modifications, repayment, fees, and reamortization schedules for each deal and automatic updates dependent on future cases.

Human-Centered Communications

Many lenders are concerned about outsourcing loan servicing management because they do not want to disassociate with their borrowers. It is critical to adopt a loan servicing system that gives importance to human centered communication and works in the lender’s and borrower’s best interests.

Complete Services

CDFI loan servicing software should handle origination, collections, and repayments. Bundling these services enhances operational efficiency and reduces stress. Your originations, customer service, and collections departments continually contact you to avoid mistakes. With the right loan servicing system, the organization will also ensure compliance.

The Fundingo Solution

When it comes to a CDFI loan servicing system, it is important to focus on making a difference in your community by using Fundingo’s end-to-end loan management system and the best tools for CDFIs to take your lending program to the next level.

Fundingo helps to:

- Optimize Back Office Procedures

- Increase Deal Volume Capacity

- Minimize Manual Function Time

- Impact Reporting and Dashboards

- Enhance Visibility and Customer Experience

- Reducing Response Time

Fundingo is an all-inclusive CDFI loan management system. Get in touch with an expert today to schedule a demo.

Lending Tips

Maintaining a competitive edge in today’s alternative industry is not an easy undertaking. If a company is to succeed, it must place a high value on its relationships. It is, however, very different in today’s commercial world to manage and preserve these partnerships. Building relationships with existing and new customers, increasing revenue and ensuring that the correct information gets sent to them at the right time requires more than just sector expertise.

Enter Salesforce Financial Services Cloud.

What is Salesforce Financial Services Cloud?

Salesforce Financial Services Cloud is an integrated platform meant to foster generational customer relationships. Powered by Lightning, Financial Services Cloud makes it simple for advisors to provide the concierge-level service and tailored, proactive advice that clients expect. In the end, advisors may spend less time gathering client information and more time giving comprehensive, goal-based advice that places their clients at the center of everything they do with an upgraded set of productivity and engagement tools.

What Business Value Does Salesforce Financial Services Cloud Provide?

Every customer’s life cycle is unique, and Salesforce Financial Services Cloud provides the ability to see the customer’s journey from start to finish. It can solve any problem firms confront, regardless of the financial services sector they are in, and thus, is important in keeping up with the challenges of the changing times.

Who can Take Advantage of Financial Services Cloud?

Financial Services Cloud delivers an integrated platform that you can adapt to the high-touch relationship model of any financial services organization. From CDFIs to MCAs, Financial Services Cloud can enable your team to provide personalized advice at scale across any channel or device.

What Functionalities Make it Different from Other Salesforce Products?

Industry experts have established that Salesforce’s Financial Services Cloud is the best-suited cloud solution for financial services firms since its debut in August 2015. Wealth management organizations, insurance companies, and banks all use this service, a combination of the Sales Cloud and Service Cloud. FSC can help bankers and financial advisers better understand their customers to tailor their sales approach to meet their needs.

Specifically, Financial Services Cloud has all the fundamental Sales Cloud functionalities and new custom fields and objects that model financial accounts, assets, liabilities, and goals for both individual clients and entire households rendering it a formidable option for building your loan management solution upon. This functionality means that advisers no longer need to spend time and money customizing their CRM to speak the language of their organization.

If you are looking for a digital solution to organize your processes as an alternative lender, check out how Fundingo leverages the Salesforce platform to help you.