An efficient underwriting process is essential to alternative lenders. It ensures that applications are processed quickly, risk is evaluated accurately, and prices and terms are set appropriately. Without a sound underwriting process in place, alternative lenders struggle to grow profitably and succeed.

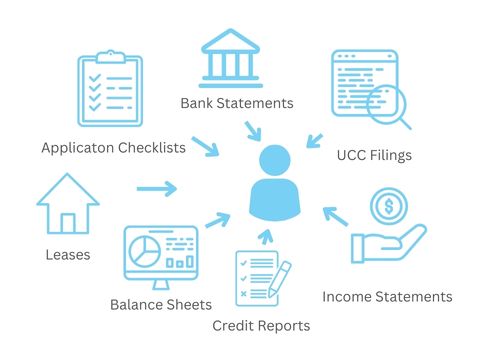

Yet many alternative lenders rely on an inefficient, patchwork underwriting process. Data is pulled from a variety of sources, but not stored in a central location, making it difficult to access and use. Credit reports, UCC filings, bank statements, income statements and balance sheets, leases, and other important documents are all in separate places, making it difficult for underwriters to keep track of them.

Underwriters must collect data from multiple sources.

The Costs of a Broken Underwriting Process

By relying on a disjointed underwriting process, with vital information scattered in various places, lenders create for themselves several costly problems.

| The Cost of a Broken Underwriting Process |

| Inefficiencies and delays |

| Inaccurate data and higher risk |

| Inconsistency processes and lack of control |

Inefficiency and delays: A patchwork process slows down underwriting, making it difficult to respond promptly to prospective borrowers. Given that most borrowers submit applications to multiple lenders and expect a rapid response, delays mean that opportunities are lost to competitors. Borrowers won’t wait.

“For bank loans and loans backed by the Small Business Administration, for example, it’s common to wait 90 days before you receive an initial response… if you’re applying for a merchant cash advance, you might hear back within just a few hours.”

– Funding Circle

Inaccuracy and higher risk: A disjointed underwriting process that stores information in multiple systems is vulnerable to oversights and inaccuracy. Important information can get lost or overlooked. Without complete and accurate information at hand, lenders are likely to miscalculate the risks of certain loans or set inappropriate terms and conditions.

Inconsistency and lack of control: When underwriters work with a patchwork system, it is difficult to enforce standards for underwriting across the portfolio. Each loan application may follow a different underwriting process, or the standard may vary from one application or one underwriter to the next. Without a means to enforce underwriting standards, there’s a lack of consistency and control.

Each of these problems created by a poor underwriting process directly affects an alternative lender’s ability to grow profitably. Lenders ignore them at their peril. The problems won’t go away by themselves and will become more acute over time. Decisive action is required to fix the process.

Better Solutions are Available

Fortunately, remedies are available that replace the inefficient, disjointed, and risk-prone systems that many alternative lenders rely on. These better solutions support a more effective underwriting process.

| Benefits of An Automated Solution |

| Centralized Information |

| Standardized Processes |

| Automated Pricing |

| Integration of Data Sources |

Centralize all information: New systems make all information relevant to each loan application easily accessible, not spread out over multiple systems. Centralizing the information makes the process more efficient and more accurate. Documents aren’t misplaced, information isn’t manually transferred from one place to another, and applications are processed more quickly. The result is that applications are assessed more accurately and more are converted into deals.

Centralizing all data makes the process more efficient and accurate

Establish a Standard Process: The new underwriting software supports greater consistency and reduces risk. All applications are reviewed via a standard workflow. This ensures that all required elements are accounted for. Missing information is flagged, stips are specified, and requests for more documentation are automatically sent to applicants.

Automated Pricing: New underwriting software can automatically calculate pricing and terms for each deal, following established guidelines. This ensures greater consistency in developing offers and maintaining standards.

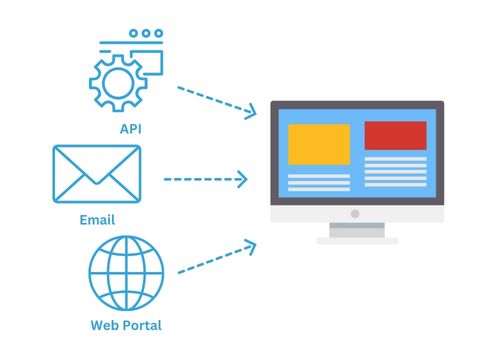

Streamlined Data Source Integrations: No underwriter can do their job without data to verify and manage risk. A quality system will seamlessly integrate sources of borrower verification data, such as LexisNexis, Experian, and DecisionLogic. Essential information can be automatically added to application records or run through a series of workflows to evaluate risk.

Selecting an Underwriting Software

As alternative lenders consider more advanced solutions to support their underwriting process, they should consider several key criteria in addition to particular features and functions.

| Key Characteristics of an Automated Underwriting System |

| Proven Solution |

| Reliable, accessible platform |

| Configurable |

| Expert Support |

Work with a proven solution: Alternative lenders should get the benefit of an underwriting software that’s been successful with other lenders. They don’t want to be working with a vendor or a system that’s not been proven in the real world.

Select a solution built on a reliable, accessible, and secure platform: Because underwriting is essential to the lending process, lenders need a solution that’s always available and can be accessed from anywhere on any web-enabled device. The system should also ensure that all data is secure. A proven platform, such as salesforce.com, would meet these standards.

Allow for configuration: Because each alternative lender may have developed its own particular process for underwriting, they should select software that can be configured to fit their own process. It should be easy to build workflows and establish standards that suit each lender. They should avoid a “one size fits all” solution that forces lenders to adjust their process to fit the system.

Supported by alternative lending experts: Alternative lenders considering better software to support underwriting should assess the background and expertise of the people who have built and support the solution. The solution and team behind it should understand the unique needs of alternative lenders. The solution should have been built from the ground up to meet their specific requirements. A “generic” lending solution, adapted from a different market, is unlikely to properly address the needs of the segment.

About the FUNDINGO Loan Management Solution

FUNDINGO is a loan management solution designed specifically for alternative lenders. It streamlines the entire process of originating, underwriting, and servicing loans.

Unlike a hodge-podge of outdated and unconnected systems, each handling only a single element in the lending process, the FUNDINGO solution helps alternative lenders attract and close more deals, accelerate the underwriting process, generate more pricing options, reduce errors, and ensure greater consistency. These lenders also earn a more professional reputation among borrowers, brokers, and syndication partners.

The FUNDINGO solution is built on the salesforce.com platform and can be closely integrated with a company’s CRM, finance, document management and other systems. The solution is supported by experts in alternative lending loan management.