Table of Contents

Keys to Successful Implementation of Your Loan Servicing Software

As lending businesses grow and expand, their offerings for loan products increase naturally followed by much-needed evolution in their regulations and policies. These changes often lead to an unavoidable need to root out their existing, straggling system and replace it with agile software.

That said, however necessary that replacement may be, it is never an easy decision to make and accept (at least initially). However, it is essential to not let fears get in the way of moving on to better things for enabling your business to climb the ladder of success, and when you’re in the lending business you are well aware of the core importance of a loan servicing software.

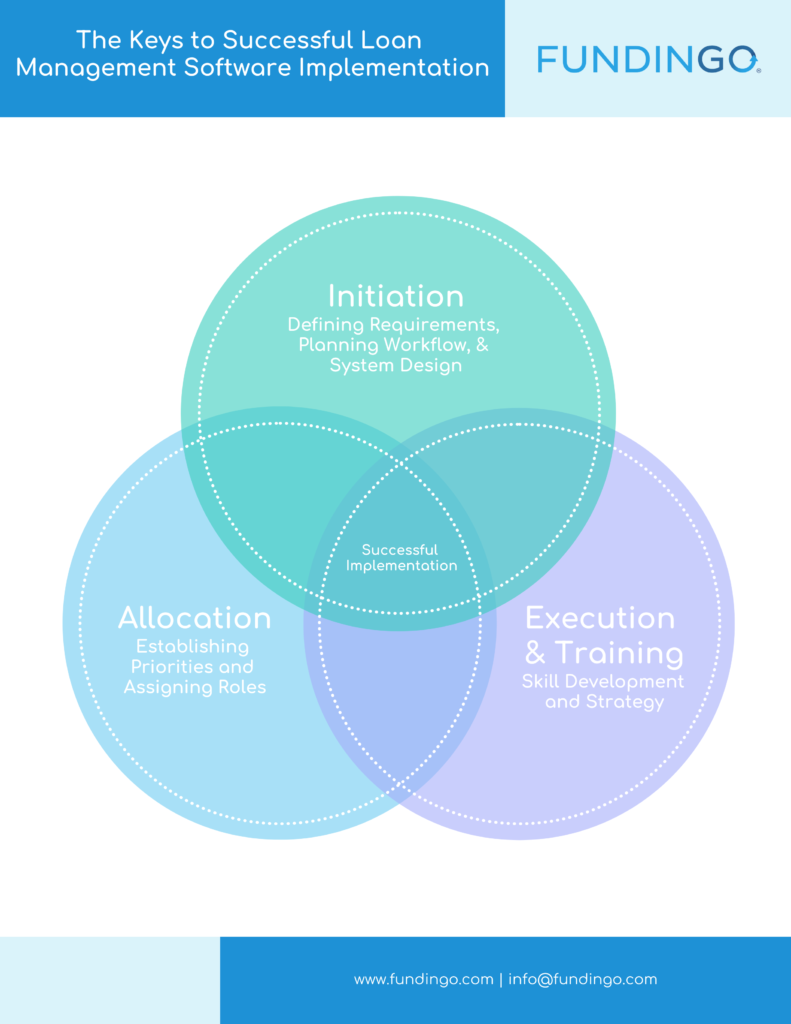

Loan servicing software is what keeps tabs on all your details such as your policies, loan terms, interest rates, loan payments, and collections. This makes it all the tougher to choose the best loan management system, and once you’ve made your decision, it’s important to be aware of the key factors that enable smooth and successful implementation. These are the top three factors that our team has determined from its extensive experience:

- Initiation – Defining Requirements, Planning Workflow, & System Design

- Allocation – Establishing Priorities and Assigning Roles

- Execution and Training

Initiation – Defining Requirements, Planning Workflow, & System Design

As mentioned above, you cannot stress enough the importance of the right loan servicing software when you are in the lending business- therefore you must carefully determine the right software for your organization. Being clear in your requirements is the first and most important step in flawless implementation. For this, all team members must share their input which must be valued and carefully studied. This includes the departments of collections and customer service as well.

Ensure the use of the same terminology regarding the new software among the entire workforce i.e., your in-house team as well as your loan servicing software provider. This will ease communication and understanding. That said, the software implementation manager must draw a detailed outline regarding the project plan and conduct a launching meeting to explain new workflows, project requirements, establish milestones, and set expectations regarding the completion of implementation.

Allocation – Establishing Priorities and Assigning Roles

Once the implementation process has been initiated and the workflow with the new loan servicing software has been designed, you will need to finalize the scope of the implementation. You must establish priorities keeping any prerequisites into account, divide the implementation process into smaller phases, meet deadlines, and ensure that the most important tasks are catered to before the others.

In the whole stage of allocation, the lender must take and exhibit proper sole project ownership. Consultants, vendors, and even your employees are there to just serve their essential individual roles in the process. As a lender, however, you know your business the best and you alone truly know the details and importance of your business goals. Use that ambition and knowledge to ensure the completion of the implementation process. If a lender doesn’t take project ownership, that ship is bound to hit rock bottom.

The lender must put together a committee of executives who take ownership of the project, ease decision making, cater to the need for resources, and encourage accountability. There must also be a dedicated project manager who solely focuses his energy, efforts, and skills on keeping the implementation process steady and the team organized. Moreover, the project team member must be empowered to make decisions to support the strategies that are a part of your business case. Otherwise, they will have to seek approval from multiple layers of senior management even for small business decisions. Therefore, to avoid delay in the implementation process, you must ensure that your team is sufficiently empowered.

Moreover, when it comes to key areas of your lending business such as accounts, collections, IT, and customer service, you must identify the experts. The experts will be able to promptly deal with any issues in their domains and will save you precious time, thereby facilitating the implementation process. With that done, you must conduct regular staff meetings to keep tabs on the software implementation status and to ensure transparency, visibility, and good pace. We at Fundingo, hope that you will benefit from the insights gained from our experience of facilitating clients with our software implementation for years.

Execution and Training

If your team isn’t trained to use and manage the new loan servicing software, by the time it goes live, it will create a lot of lag and chaos. Therefore, you must develop a training schedule in a timely manner and begin it as soon as possible. The training sessions can be conducted on-site, online, or be pre-recorded. Use workflows from the initiation phase of software implementation for the user training content. The need to prepare your business organization workforce and your user communities to use the new software is crucial. You will need to prepare an effective communication strategy that clears any ambiguities the users may have. You must set the tone right from the very start and make sure to answer the key questions that people may have in their minds such as:

- Why are you opting for new software?

- Which issues will the new software resolve? (in case your firm is not a new venture)

- How will it benefit the end-user?

- When will the changes occur?

- How will those changes be implemented?

Communicate the answers to these questions through frequent communication, short and precise demos, and newsletters. Once you have sufficiently trained your personnel and everybody knows their duties, has a thorough understanding of the new software both in terms of usage and expectations, and set up a date for going live with your new software, make sure to assign minimal work for that date. On a side note, it’s always a good idea to choose a weekend for going live.

Even after your now loan servicing software has been successfully implemented, it’s best to maintain ongoing support for all those dealing with it firsthand. Arrange additional training sessions, provide tech support, and always be ready to facilitate your entire team as implementation is only the beginning of your fresh start.