Modern Tools for CDFIs

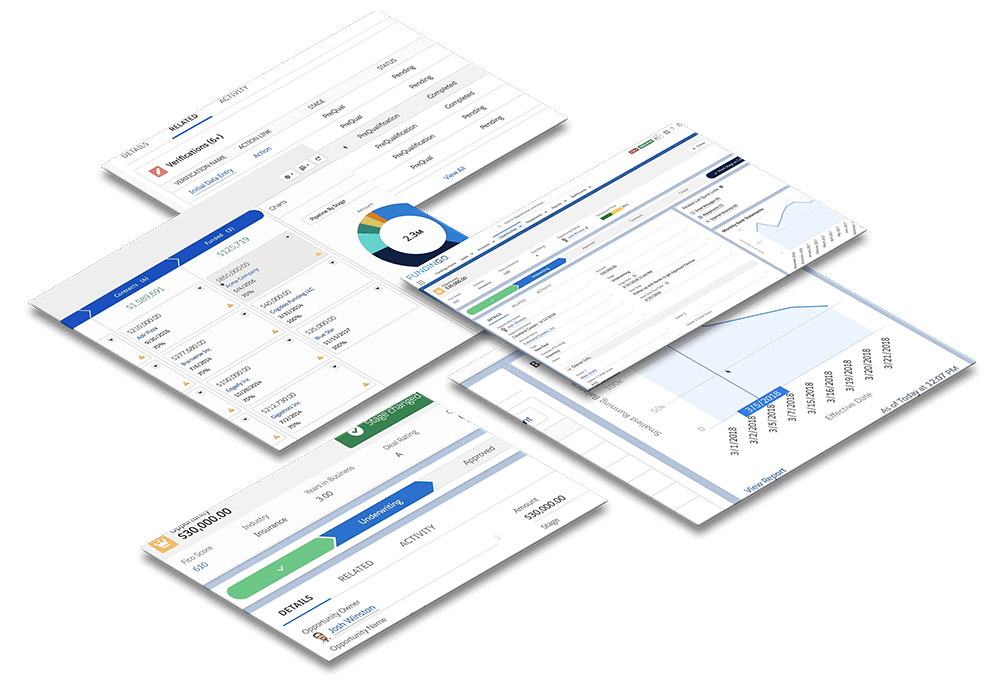

Focus on impacting your community by taking your lending program to the next level with Fundingo’s end-to-end loan management solution and best tools for CDFIs. Manage your loan portfolio more efficiently and fund projects that have a major effect on the local economy.

Faster processes. Fewer errors with best tools for CDFIs.

Fundingo does what you need faster so you can do what you want sooner. Automate processes such as NACHA file generation, recurring payments, and fee schedules with our CDFI loan servicing software. Choose from our list of available integrations and reduce manual input.

It’s the little things in life that are important. Don’t lose sight of the details. Fundingo keeps track of draw requests, properties and insurance, inspection status, and more. See all info related to your deals with easy-to-use visual dashboards and customizable views.

Streamline Back Office Operations

Bulk actions, feature automation, and customizable flows

Increase Deal Volume Capacity

Reduce Time Spent on Manual Functions

Impact Reporting and Dashboards

With Fundingo, have the ability to track and report your impact on the community. Save 16+ hours per month on generating manual reports.

Improve Visibility and Customer Experience

All customer information stays connected in Salesforce

Reduce Turnaround Time

Underwrite, approve, and service deals faster with complete information at your fingertips

What could your company do with more time? Take on more deals? Provide better service?

See what one of our customers did after implementing Fundingo.

Billd was growing too quickly to rely on manual disbursements, but put their trust into Fundingo on Salesforce to provide a solution. Their biggest concern was cutting down time spent on tasks that could be automated and leaving no room for human error.

Our Clients

We’ve built Fundingo with adaptability in mind.

Our solution ranges from essential functionalities to servicing interest-based lending.

Fundingo’s Features

- Construction loan management

- Customizable payment waterfall

- Streamlined loan boarding user interface

- Loan and disbursement templates

- Enhanced amortization schedule features

- Payment creation component with distribution

Team Support

- Set-up and configuration

- Training your team to use Fundingo

- Ongoing program support

Schedule a call with us to see how we can save you time.

Our Process

Here’s how our process works:

- Schedule a call so we can get to know your needs

- We give your team a tailored demo of Fundingo

- Our team outlines your current processes

- We show where Fundingo will complement or replace your existing procedures

- Final overview of the requirements

- Our team implements Fundingo

FUNDINGO is an end-to-end loan management solution that reduces overheads, grows revenues, and helps you to make better decisions, faster. Built by industry experts who specialize in meeting the needs of alternative lenders, FUNDINGO delivers greater efficiency, better risk management, and tighter control.

%

application intake

%