Table of Contents

How Tech Solutions are Changing Lending

If you work in lending, you may have noticed that technology is changing the landscape of how we operate. Perhaps you’ve encountered buzzwords such as ‘Automation’, ‘FinTech’, and ‘SaaS’. These terms represent more than just trends- they exemplify some of the innovation that is driving our industry forward, and it is crucial to understand how to harness that potential.

Financial Technology, better known as FinTech, initially referred to back-end systems technology, but has now evolved to describe consumer-oriented services such as those included in the lending process. Fintech facilitates entrepreneurs and businesses in managing their financial operations with ease, facilitates automation of the financial services, and aims to improve the user experience.

FinTech has eased the lending process largely through the automation of core functions in the life cycles of loans. Loan origination software enables end-to-end automation and management of the entire lending process. Each phase of the loan process, namely: pre-qualification, submission of application, application processing, underwriting, approval of application, documentation, credit check, and loan funding are automated and managed through a loan management software.

Why is lending turning to technology?

Today’s customers are tech savvy, and businesses need to be even savvier. Clients expect easy access to applications and speedy turnarounds. In order to keep up and save time, companies are increasingly turning to automation. When it comes to qualification, leveraging third-party data sources allow lenders to assess potential customers and ensure eligibility. These sources provide huge volumes of data that need to be efficiently processed to align the relevant information, which is easily done through using a loan management software. The result is less time wasted on manual processes for lenders and faster loan servicing for the customer.

What are the Benefits of Automation and Loan Management Software?

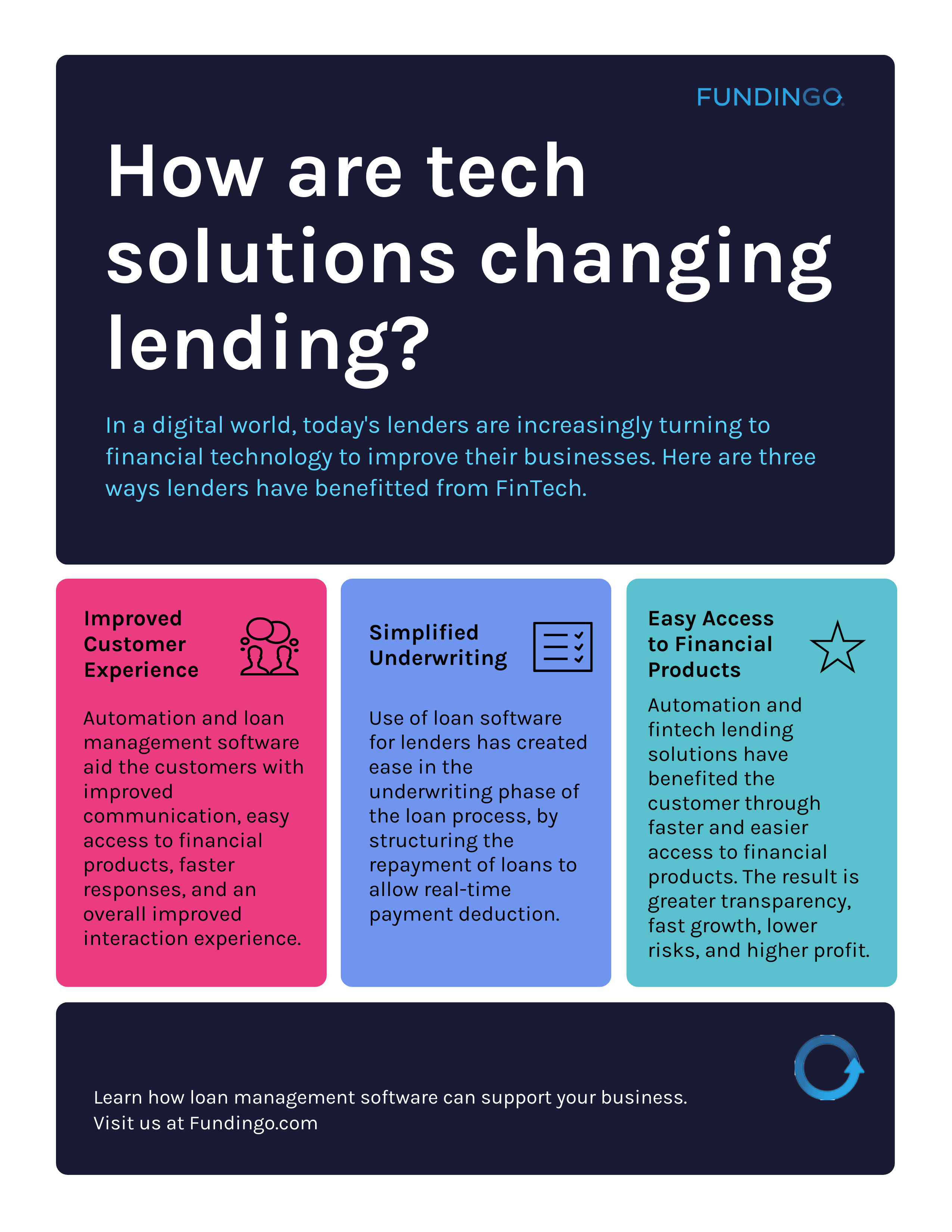

Improved Customer Experience

In the past the 4P approach of marketing focused solely on the Product, Price, Place, and Promotion of a good or service. However, with time businesses evolved to a more customer-oriented strategy that is both rewarding and builds long-lasting customer relationships. This approach focuses on enhanced communication and customer-friendly solutions. Automation and loan management software aid the customers with improved communication, easy access to financial products, faster responses, and an overall improved interaction experience.

Additionally, automation and loan management software allow direct disbursement of funds into customers’ bank accounts, require considerably less documentation, and ensure seamless delivery. Lending companies are investing in dedicated customer care teams and reaping the rewards in the form of increased return on investment. Automation has served both the companies and the customers by easing the whole lending process; more options in the market have led to increased competition and better choices.

At Fundingo too, we strive to provide instant and accurate insights at each phase of the lending process with our loan origination software. Apart from offering a seamless lending process, we believe in maintaining a loyal customer base. Customers can enjoy a smooth and streamlined loan service experience from a single, efficient platform.

Simplified Underwriting

Use of loan software for lenders has created ease in the underwriting phase of the loan process, by structuring the repayment of loans to allow real-time payment deduction. Customers do not require mortgages for underwriting their application either. At Fundingo, we have fundamentally restructured loan servicing by transforming hours of loan servicing time to merely a matter of minutes.

Easy Access to Financial Products

Automation and fintech lending solutions have benefited the customer through faster and easier access to financial products. Due to this easy access, previously neglected businesses and customers have benefitted from cost-effective and fast credit options too. Apart from this, loan management software platforms such as Fundingo offer complete transparency from the origination stage through underwriting to renewals and loan services. This enables fast growth, low risks, and significantly higher profits.

Final Verdict – The Significant Importance of Automation and Loan Software for Lenders

Tech Solutions have revolutionized the lending process, and for the better. Customer-centric approach is the need of the hour, and time is of the essence. By acknowledging the concerns of customers and providing quick and easy access to financial products and services, automated lending has come here to stay. If you want to leverage automation and tech solutions for optimizing your business, contact Fundingo for their loan management software offering complete transparency and the opportunity to benefit from high profits with low risks.