Image courtesy of Vecteezy.com

WHAT IS ALTERNATIVE LENDING?

With an increase of small business owners across the U.S., organizations have often experienced difficulties when it comes to making money. Fortunately, the Alternative Lending industry has developed as a solution.

Alternative Lending describes loan options available to consumers and business owners besides a bank loan. These alternative methods are often used where a person or business owner is unable to obtain a bank loan for any reason. Some lenders specialize in using less secure securities such as real estate or residual invoices to protect loans. They are generally more flexible than banks when it comes to payment systems and loan approvals and often offer cash much faster than their traditional banking counterparts. The Alternative Lending industry is well established and often has well-respected employees of the financial services community.

EVOLUTION OF ALTERNATIVE LENDING

The first major lenders in the United States, Prosper and Lending Club, arrived on the scene in the mid-2000s providing personalized peer-to-peer lending. This introduced a new lending system that has grown into a business venture. Historically, banks have viewed small businesses as financial risks, preferring to finance larger enterprises.

For new business owners who need help getting started and who do not yet have a proven sales record, it can be very difficult to qualify for a bank loan. One usually needs not only excellent personal and business credit, but also proof of income, financial efficiency, and at least a few years of experience in running the business. And in many cases, banks prefer to lend in large sums, which small businesses rarely need.

After the economic downturn in 2008, financing for small businesses declined sharply, leaving room for some lenders to close the gap. According to the Wall Street Journal, interest rates have dropped by 38% over an eight-year period; The top 10 banks offered joint venture loans of $ 72.5 billion in 2006, but $ 44.7 billion in 2014. Some lending companies began lending businesses to help small businesses avoid bankruptcy.

HOW IS ALTERNATIVE LENDING DIFFERENT FROM TRADITIONAL LENDING?

Some loans are usually faster, more affordable than regular loans. Unlike banks, which usually require you to submit a detailed business plan and dozens of financial documents, all of which can take months to consolidate, different lenders usually only need your credit notes and the latest tax returns and bank statements.

Thanks to advanced micro-contractor systems that incorporate advanced human technologies, various online lenders can speed up the writing process and postpone a decision very quickly. As a result, lenders can issue answers within days, or sometimes even hours.

Applying for a bank loan, on the other hand, is often a long and difficult process. The average waiting period is three months for a response. And once you have heard, you may need to arrange your meeting in person and provide copies of your financial statements as part of the accreditation process. These extra steps can take a lot of time and effort to run your business.

Other loans are also more flexible in terms of borrowing and pricing. Although banks generally do not consider it financially advisable to borrow less than $ 250,000, some lenders offer loans of up to $ 5,000.

WHAT TO LOOK OUT FOR IN ALTERNATIVE LENDING IN 2022

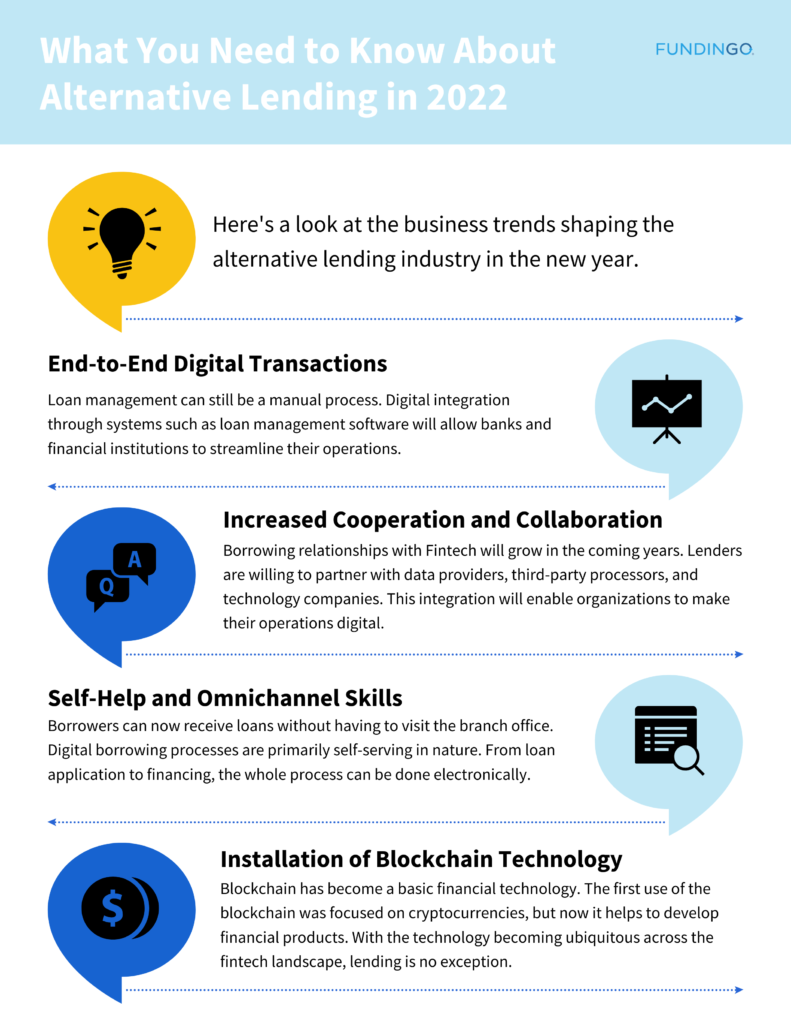

Lending trends for 2020-21 involve lenders’ focus on comparing consumer expectations, using the omnichannel, and improving lending efficiency. Now, let’s look at lending business trends that will shape the industry by 2022.

End-to-End Digital Transaction

The most important trend in lending will be to increase digital productivity. Loan management can still be a manual process. Since accuracy is important in this business, a lot of manual labor goes into document verification. All the steps – from applying for a loan to the issuance and collection, including manual labor. Lending businesses that still rely on these legacy systems will need more pressure to perform their digital operations. For customers, doing digital will bring ease. Digital integration through systems such as loan management software will allow banks and financial institutions to streamline their operations.

Increased Cooperation and Collaboration

Borrowing relationships with Fintech will grow in the coming years. Lenders are willing to partner with data providers, third-party processors, and technology companies. This integration will enable organizations to make their operations digital.

Self-Help and Omnichannel Skills

Borrowers can now receive loans without having to visit the branch office. Digital borrowing processes are primarily self-serving in nature. From loan application to financing, the whole process does not require manual intervention. Customers will not be required to contact creditors unless required. These machines also free workers from work.

Installation of Blockchain Technology

Blockchain has become a basic financial technology. The first use of the blockchain was focused on cryptocurrencies, but now it helps to develop financial products. Simply put, it is a shared, encrypted website – a distributed ladder. It makes the banking process faster and less bureaucratic.

Although banks have grown more sensitive to lending to small and medium enterprises – largely due to increased regulatory responsibilities – businesses in the central market are still able to access credit opportunities through these financial institutions. With a simple borrowing process and easy access to key capital, lenders are a very attractive option, which introduces the potential for potential growth and profitability in the future.

PROS AND CONS OF ALTERNATIVE LENDING:

Alternative forms of Lending were designed to give small businesses easy access to finance, as well as additional opportunities for growth, job creation, and profitability. With the help of alternative lending, one can upload all information with just a few clicks at a convenient time without wasting time preparing paperwork, writing a business plan, or attending a bank meeting during normal business hours. Clients can have twice the chance of being approved by another lender. Whether you need to make a down payment on a new office building, replace damaged equipment, or repurchase a best-selling stock, various lenders work quickly to get your money back, sometimes bringing you money in just a few hours. With some lenders, you can choose from a few of the financing options to find the one that works best for you. Whether you want $ 5,000 to upgrade to a savings office, need to use the remaining invoices as collateral to protect your mortgage, or need $ 30,000 to renovate buildings, other lenders can help.

Problems with Alternative Lending are few, but important to note. Here are two factors to consider: Banks do not accept almost as many applicants as other lenders, so they may charge lower interest rates. Consider: APR 3-6% of traditional bank loans compared to 10-30% of APR for non-bank lenders, depending on the type of loan and the company. If you do not budget carefully with another lender, you may end up spending interest instead of thinking about how you can improve your profits. However, not all unique lenders will pay off debts, and many offer a non-binding application to assess what you qualify for without charge. Some lenders usually have shorter borrowing terms than banks – about one to five years. Borrowing existing businesses is a risky investment, but the short term is also because different lenders tend to borrow less than banks. With less money to pay off your debts, you may have major monthly payments, which may mean that you may be forced to suspend certain business plans or end up running out of money.